Model Risk Management

ESG & Climate Risk

Harness the power of ESG and climate risk modeling for informed decision-making and risk management.

Overview

Integrating ESG & Climate in Risk Management

In today’s rapidly evolving landscape, environmental, social, and governance (ESG) concerns have become a driving force behind decision-making frameworks. However, accurately modeling and incorporating ESG risks into financial institutions’ processes can be a daunting task. At Evalueserve, we specialize in overcoming these challenges, offering cutting-edge solutions to help banks, asset managers, and financial services firms harness the power of ESG modeling.

Our ESG solutions are proven to help clients rigorously develop and validate several models efficiently and in a time-based manner. As the importance of ESG data integration continues to grow, our solution provides comprehensive support for ESG risk modeling. From our experience with working on ESG and Climate risk models such as transition risk and physical risk scenario models, and ESG scorecard models we have developed an expertise in ESG and Climate risk modelling. Our goal is to equip financial institutions with the tools they need to understand and navigate the complexities of ESG risks and comply with ever-changing regulations.

Our Capabilties

Support Across the Model Lifecycle

Evalueserve provides comprehensive support throughout the entire model risk management (MRM) lifecycle, encompassing model development, validation, ongoing monitoring, and thorough documentation. Experience an expedited MRM performance with process automation driven by technology.

ESG Scorecard Model

Develop and monitor ESG scorecard model applicable to Corporates, Municipal Bonds, and Sovereigns. Evaluate the influence of distinct Environmental (E), Social (S), and Governance (G) risk factors and categories on the ESG risk rating and continuously monitor the portfolio's performance to gauge its ESG-related outcomes.

Physical Risk

Create physical climate risk models, conduct scenario analysis, and perform stress testing that encompasses acute and chronic risk factors. Evaluate how climate change impacts the portfolio in terms of physical risks.

Transition Risk

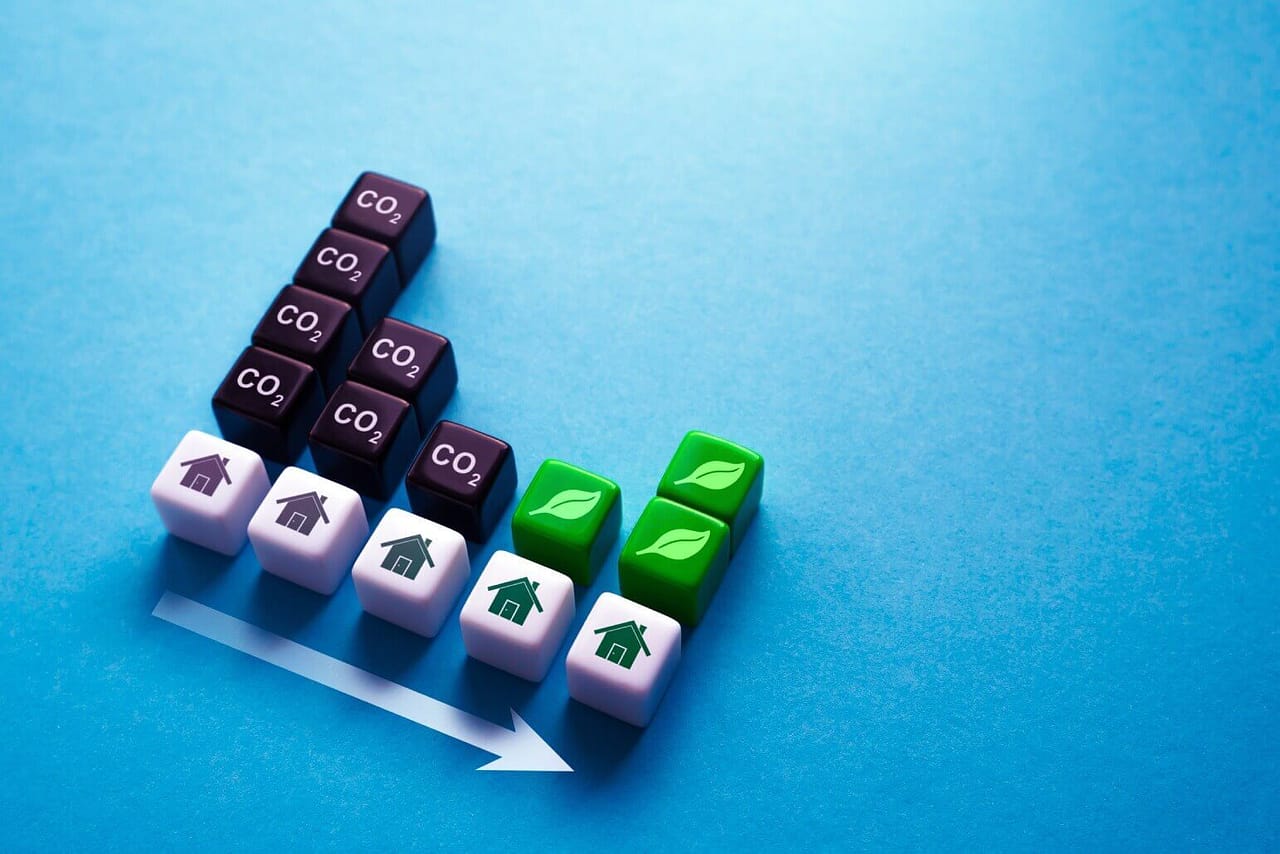

Develop transition climate risk models, conduct scenario analysis, and perform stress testing to evaluate the effects of transitioning to clean and green energy. Assess how this transition impacts various risk factors, including market, credit, and counterparty credit risk.

Related Resources

Optimize Your Outcomes

Natural Resources Portfolio Allocation

Discover how Evalueserve helped an asset management firm optimize portfolio allocations using Modern Portfolio Theory, ensuring accuracy and resilience in ESG-focused investments.

Forecasting Scenarios of Greenhouse Gas Emissions of Real Estate Portfolios with a Transition Risk Model

Discover how Evalueserve’s comprehensive validation of an asset management firm’s carbon emissions model ensures accuracy and compliance, supporting sustainable investment strategies.

Fortifying ESG Fund Composition through Rigorous Assessment of Corporates’ ESG Leadership

Discover how a leading asset manager enhanced their ESG funds through a validated in-house rating model, enabling informed investment decisions and strategic alignment.

Managing Long-Term Physical Risk of Climate Threats to Real Estate Investments

Learn how Evalueserve’s thorough validation of a climate risk model empowers asset managers to make informed decisions, enhance financial performance, and meet ESG goals.

Our Products

AI-Powered Products That Scale

Spreadsmart

Automate financial data extraction for valuation. Improve accuracy and increase the speed of financial spreading by 70%.

Insightsfirst

AI-enabled platform that empowers you to get an edge in the market through differentiated insights and recommendations.

Insightloupe

Combination of human expertise and best-in-class technology to patent landscaping; obtain expert–backed IP and R&D insights.

Publishwise

An AI-powered platform that lets users swiftly recommends content for proposal creation using intelligent search, NLP and ML.

- Solutions for Financial Services

Related Industries

Additional Industries

Investment Banks

Corporate & Commercial Banks

Asset & Wealth Management

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.