9M’24 Highlights

M&A volume increased but number of deals fell to eight-year low

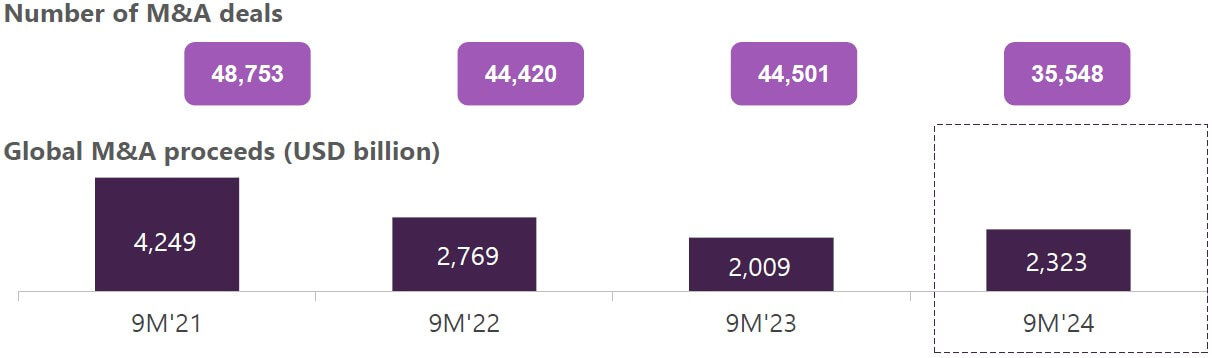

In 9M’24, the number of announced M&A deals declined by 20% to 35,548 globally, compared with 44,501 in 9M’23. However, total deal value rose by 16% to USD2.3 trillion, making 9M’24 the strongest first nine months for deal-making since 2022.

Regionally, M&A activities were up in the US and Europe, by 18% YoY and 30% YoY, respectively, with the US accounting for 48% of total deal volume, the highest since 9M’19. Conversely, with an 8% YoY decline in overall activities, 9M’24 was the slowest first half for APAC M&A since 2013. High inflation and interest rates, geopolitical tensions, and political uncertainty seemed to have had an impact on global M&A activity.

Globally, the technology and energy & power sectors led the way, each accounting for 16% of total deal value, largely driven by mega deals.

Debt capital markets remained solid

In 9M’24, global debt capital market (DCM) activity touched USD8.3 trillion, up 18% compared to 9M’23, making it the strongest first nine-months for DCM since 2020. New DCM offerings rose by 9% YoY to an all-time high of nearly 25,000. Investment-grade corporate debt issuances increased by 19% YoY, while high-yield activity surged by 86%, marking a three-year high. Green bond issuance stood at USD381 billion, up 8% from the previous year’s level, despite a 15% drop in Q3’24 vs Q2’24. Regarding sectoral activity, all industry sectors registered YoY gains, led by the healthcare, media & entertainment, and retail sectors, all of which witnessed strong double-digit percentage increases, compared with 9M’23.

ECM activity reached three-year high

Global equity capital market (ECM) activity climbed to USD445 billion in 9M’24, up 8% YoY, marking the strongest first nine-months for global ECM in three years. The US accounted for 35% of total issuances, with proceeds up 47%, compared with 9M’23. However, ECM activity in China declined by 62% YoY, marking its lowest share of global ECM in the first nine months since 2008. Global IPOs, excluding SPACs, totaled USD70 billion, down 24% YoY, marking the slowest opening period for global IPOs since 2009. Despite the sluggishness, total proceeds from IPOs on US exchanges went up 45%, a three-year high, compared to year-ago levels. Convertible offerings, which totaled USD79 billion, increased by 5% YoY and accounted for 18% of overall ECM deals.

The technology, financial, and industrial sectors were the most active, and together accounted for 64% of total issuance of convertible offerings.

Top five M&A deals (9M’24)

|

Date of announcement

|

Acquirer’s Name

|

Acquirer’s Location

|

Target

|

Target’s Location

|

Value (USD billion)

|

Target’s Industry

|

Deal types

|

|---|---|---|---|---|---|---|---|

|

Aug 14, 2024

|

Mars

|

US

|

Kellanova

|

US

|

29.7

|

Consumer

|

Cash

|

|

Mar 28, 2024

|

Home Depot

|

US

|

SRS Distribution

|

US

|

18.3

|

Retail

|

Cash

|

|

Feb 19, 2024

|

Capital One Financial

|

US

|

Discover Financial Services

|

US

|

35.3

|

Financials

|

Stock

|

|

Feb 12, 2024

|

Diamondback Energy

|

US

|

Endeavor Energy Resources

|

US

|

25.8

|

O&G

|

Cash & stock

|

|

Jan 16, 2024

|

Synopsys

|

US

|

Ansys

|

US

|

32.4

|

Tech

|

Cash & stock

|

Investment banks started witnessing the positive trends after a long headwinds

Investment banking revenues of major banks revived in Q3’24 due to improving global market conditions, leading to a surge in equity and debt underwriting businesses. The resurgence of mega deals, improved boardroom confidence from strong earnings, potential interest rate cuts this year, and buoyant markets were the key factors that drove the rebound. Market performance is expected to improve in 2024, due to pent-up demand for M&A and a strong pipeline, provided the macro and geopolitical environment remains stable.

Note: Revenue for Deutsche and Barclays were converted into USD using the exchange rate as of September 30, 2024; Revenue for Deutsche Bank reflects revenue from Origination & Advisory services

Bulge bracket investment banks – 9M’24 highlights

JP Morgan’s investment banking fees increased by 31% YoY in Q3’24, driven by higher fees across all products. Advisory fees rose by 10% due to the closing of a few large deals. Underwriting fees also saw a significant growth, as equity fees was up 26% YoY and debt fees up 56% YoY in Q3’24, fueled by favorable market conditions. The bank is optimistic about its pipeline but believes that the M&A regulatory environment and geopolitical situation remain sources of uncertainty.

Goldman Sachs’ investment banking fees increased by 20% YoY in Q3’24. The upside reflects significantly higher net revenue in debt underwriting, fueled by leveraged finance and investment-grade activity, and in equity underwriting, fueled by secondary offerings. The firm’s backlog increased on a QoQ basis in Q3’24, driven by the advisory segment. The firm expects its leading investment banking franchises to benefit from a continued resurgence in activity.

In Q3’24, Morgan Stanley’s investment banking revenues increased by 56% YoY, driven by continued strength in underwriting, debt underwriting, and advisory revenues. Advisory revenues increased compared to a year ago due to modestly high completed M&A transactions in EMEA. Equity underwriting revenues increased compared to a year ago due to higher IPOs and follow-ons. Fixed income underwriting revenues surged compared to the previous year, primarily due to higher non-investment grade issuances. The investment banking environment continues to improve, led by the US. The bank has healthy advisory and underwriting pipelines across several regions and sectors.

Bank of America’s investment banking fees increased by 27% YoY in 9M’24 led by debt capital market fees, mostly in leveraged finance and investment grade. Advisory revenues decreased slightly, debt underwriting revenues rose by 40% YoY, and equity revenues increased by 44% in 9M’24. The results reflect the benefits of investments in middle market investment banking and dual coverage teams.

Citi’s investment banking fees increased by 44% YoY in Q3’24, driven by investment grade debt issuances, as the clients pulled forward activity ahead of the US elections. DCM benefited from strong investment grade issuances and advisory from strong deal volume announced earlier this year. Additionally, the company saw stronger follow-on ECM activity but fewer IPOs amid market volatility in August.

Deutsche Bank’s revenues from the origination and advisory (O&A) business increased by 58% YoY in 9M’24, with growth across all business lines, as the bank maintained its number one ranking in Germany in the year to date. Debt origination and advisory revenues were up 57% and 58% YoY, respectively, in 9M’24, reflecting a growing fee pool and market share gains as the business benefitted from prior investments. Origination and advisory revenues are expected to be significantly higher in 2024, compared to 2023, driven by a continuation of industry recovery, along with an incremental impact of investments across the platform. Also, within debt origination, leveraged debt capital markets expect to build on their strong year to date performance, as market conditions remain favorable for issuances, with the increase seen in M&A activity expected to further drive demand for financing. Equity origination will continue to provide competitive offerings across product lines, while looking to benefit from a return of IPOs, an area in which the business has a specific focus. Advisory plans to build on the momentum of targeted investments made in 2023 and strong year to date performance.

Barclays’ investment banking fee income rose by 30% YoY in 9M’24, driven by increased fees in equity and debt capital markets. Equity capital market fees surged by 40% YoY in 9M’24, driven by increased deal activity (including fees booked on a large UK rights issue completed in Q2’24). Debt capital market fees grew by 38% YoY in 9M’24, due to heightened activity in leveraged finance and investment-grade issuances. Advisory fee income increased by 12% during the same period. The IB division delivered a 10.1% return on tangible equity (RoTE), reflecting the benefit of diversified income streams, across businesses and geographies. An increase in banking fees and underwriting and equities income was partially offset by a decrease in FICC and International corporate bank income.

UBS’s advisory revenues rose by 16% YoY in 9M’24, mainly due to higher M&A transaction revenues. Capital market revenues soared by 90% YoY in the same period, largely due to USD469 million generated through the consolidation of Credit Suisse revenue and other purchase price allocation (PPA) effects. Excluding these effects, underlying capital market revenues increased by 65%, with gains across all products. Revenues from debt capital and equity capital markets increased by 32% and 33% YoY in 9M’24, respectively.

Advisory firms reported strong growth despite challenging markets

Similar to investment banks, major advisory firms experienced a revival in revenues in Q3’24. Most firms recognize the heightened risks posed by the current geopolitical, economic, inflationary, and market conditions but foresee improved availability of debt capital and increased deal-making over the remaining months of 2024.

Note: Houlihan Lokey’s fiscal year ends in March (represents numbers for six months ending September 24).

M&A advisory firms – 9M’24 highlights

Evercore’s advisory fees increased by 22% YoY in 9M’24, reflecting higher revenues from large transactions as well as increased advisory fees. Underwriting fees rose by 42% YoY, due to an increase in the number of transactions. The firm expects to see activity levels increasing gradually over the coming months and the next year.

Lazard’s financial advisory revenues increased by 39% YoY in 9M’24. Since the beginning of Q3’24, the firm has been involved in significant and complex M&A transactions globally. Its leading restructuring and liability management practices managed a wide range of complex restructuring and debt advisory assignments during the period. The firm’s sovereign advisory practice remained active in advising governments and sovereign entities across developed and emerging markets.

Moelis’ revenue increased by 18% YoY in 9M’24, driven by a higher number of transaction completions across key product categories. In the last nine months, it has promoted seven advisory professionals to the position of managing director and hired eight new managing directors; one of them will join the firm’s biotech division in November 2024.

PJT’s advisory revenues surged by 20% YoY in 9M’24, driven by significant increases in revenues from restructuring, strategic advisory, and private capital solutions. For 2025, the firm continues to look confident with its improved market presence, increased mandates and a stronger backlog.

Houlihan Lokey’s revenues increased by 23% YoY in 1H’25, primarily due to a rise in the number of fee-generating events, driven by increased M&A activity. The firm’s financial and valuation advisory business is gaining momentum with market recovery. Although macroeconomic uncertainties persist, the firm remains optimistic about growth in this fiscal year, given continued improvements in M&A and capital market activity across its operational regions.

The road ahead

Revived demand for advisory services

The momentum in underwriting and advisory is expected to continue in 2024, albeit at a slow pace, driven by strong market sentiments, low volatility, and more attractive valuations. Persistently high debt costs are expected to further drive demand for IPOs and other equity issuances. Much of the recovery in 2024 will be triggered by a combination of refinancing, sustainability-led initiatives, and event-driven acquisitions. Therefore, revenues from issuances and advisory is expected to outpace that of the trading division. Stable monetary policies and low market volatility across regions should compress trading revenue growth. Nevertheless, investment banking revenues may not reach the highs of 2021 in the near term.

Rise of activist campaigns

After a brief decline during the pandemic, activist investors’ activities rebounded in 2022 and continued into 2023, despite macroeconomic headwinds and a challenging execution environment. While small and mid-cap companies still make up a majority of activists’ targets, large-cap companies now account for 30–35% of campaigns, up from 20% two years ago, with Europe leading this shift. Operational improvements and calls for management changes have taken centerstage. The current high level of activist activities, especially targeting large-cap corporations, is expected to persist.

Resilience of traditional sectors

Following the post-COVID-19 growth cycle, traditional sectors such as industrials, materials, power, and natural resources are focusing on capital market activities. Natural resources companies, in particular, have been active across different capital market verticals. More broadly, their focus on the future of energy and natural resources has led them to reevaluate and refocus portfolios through divestitures and structured separations, as well as investments through capex and M&A related to transition and technology. In FY’23, these companies represented a quarter of total transaction volumes, including two of the largest transactions globally. Over the next decade, growth is expected to be driven by renewable energy investments by traditional sectors.

Financial sponsorship of M&A to go up

In FY’23, M&A sponsorship slowed down due to rising borrowing costs, macroeconomic and operational risks, and the growth of the secondary market, which created a significant gap for improved sentiment next year. As global M&A volumes stabilize and the institutional leveraged loan market becomes more supportive of M&A financing, the environment is set for increased sponsor activity. Financial sponsors will likely remain active as buyers as well as sellers, given the availability of record levels of dry powder and the need to return capital to investors (return has been at its lowest in the last four years).

Corporate separation to continue

Corporate separation activity, in which companies spin-off parts to streamline their businesses, remained strong in 2023, despite capital market volatility. It is expected to continue in 2024. Currently, two-thirds of S&P 500 companies have three or more large segments, each generating over USD500 million in revenue. These segments are partly the result of a decade of mergers and portfolio diversification, driven by a ‘bigger is better’ philosophy, following the global financial crisis. This approach has made companies more complex, creating ample opportunity for spin-offs and carve-outs. The high level of spin-off activities in recent years and investors’ positive reactions are likely to drive similar activities in the near future.

Cross-border M&A driven by regional economic issues

Given Europe’s geographical proximity to the Russia-Ukraine and Israel-Hamas conflict areas, European economies have underperformed compared with the US and emerging markets. It has driven European companies to increase their exposure to alternative markets. Meanwhile, Japanese companies may seek cross-border mergers and acquisitions to invest capital and increase yields outside Japan, as the country continues to emerge from deflation.

GenAI deals to gain pace

Following some periodic adjustments, the overall trajectory of AI investment remained robust in 9M’24. Tech giants spent unprecedented sums in AI startups, aiming to stay ahead in the genAI boom. Additionally, the public sector is becoming increasingly involved in fostering and financing the future of AI. With the rise of genAI, more companies are prioritizing deals that enhance their tech stack and position them at the forefront of the AI revolution.

Interest rate cuts to boost M&A activity

The long-awaited Fed interest rate cut in September 2024 has been welcomed by dealmakers seeking to fund acquisitions through debt. With further rate cut expectations, combined with increasing demand for private investments, deal activity may make a notable return and increase substantially in the coming months. The current high interest rates squeeze returns, thereby placing greater emphasis on a potential deal’s value creation.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.