Financial Spreading

AI-Powered Financial Data Extraction

Accurate analysis. Accelerated extraction. Trust your Decisions.

Financial Spreading

Accelerate Financial Spreading with AI

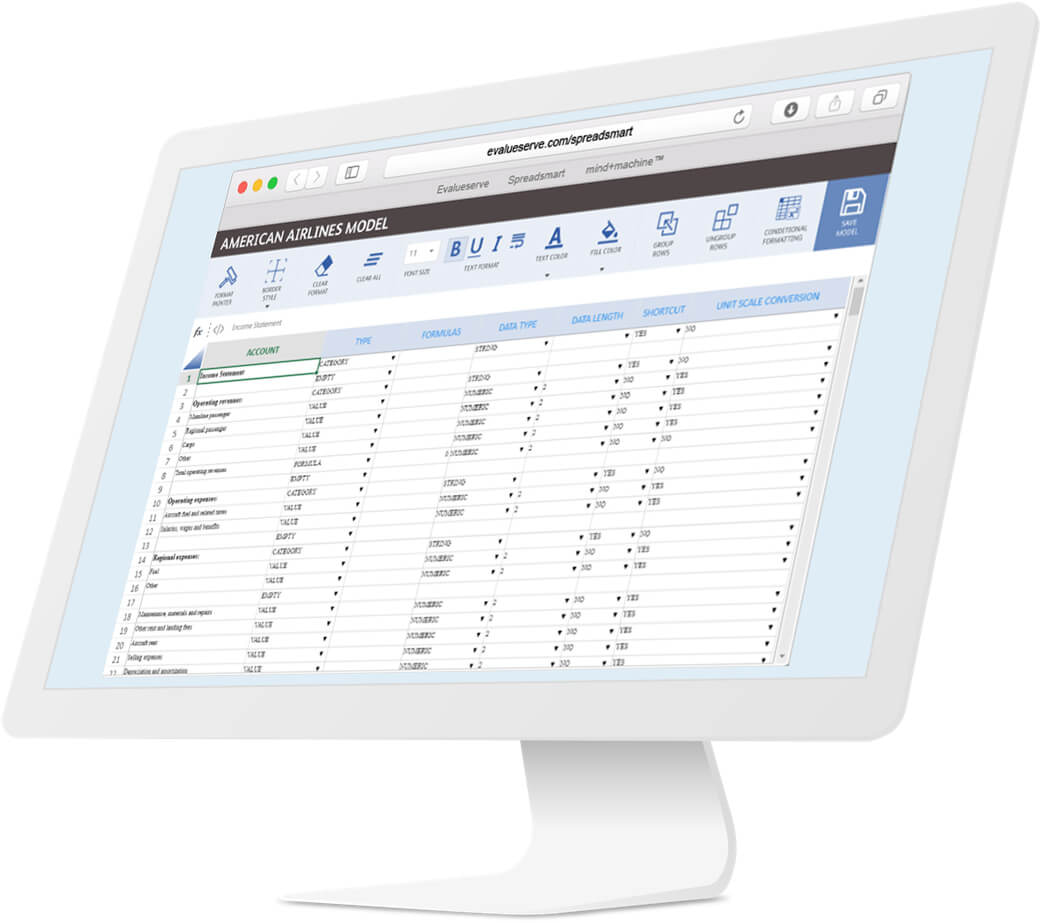

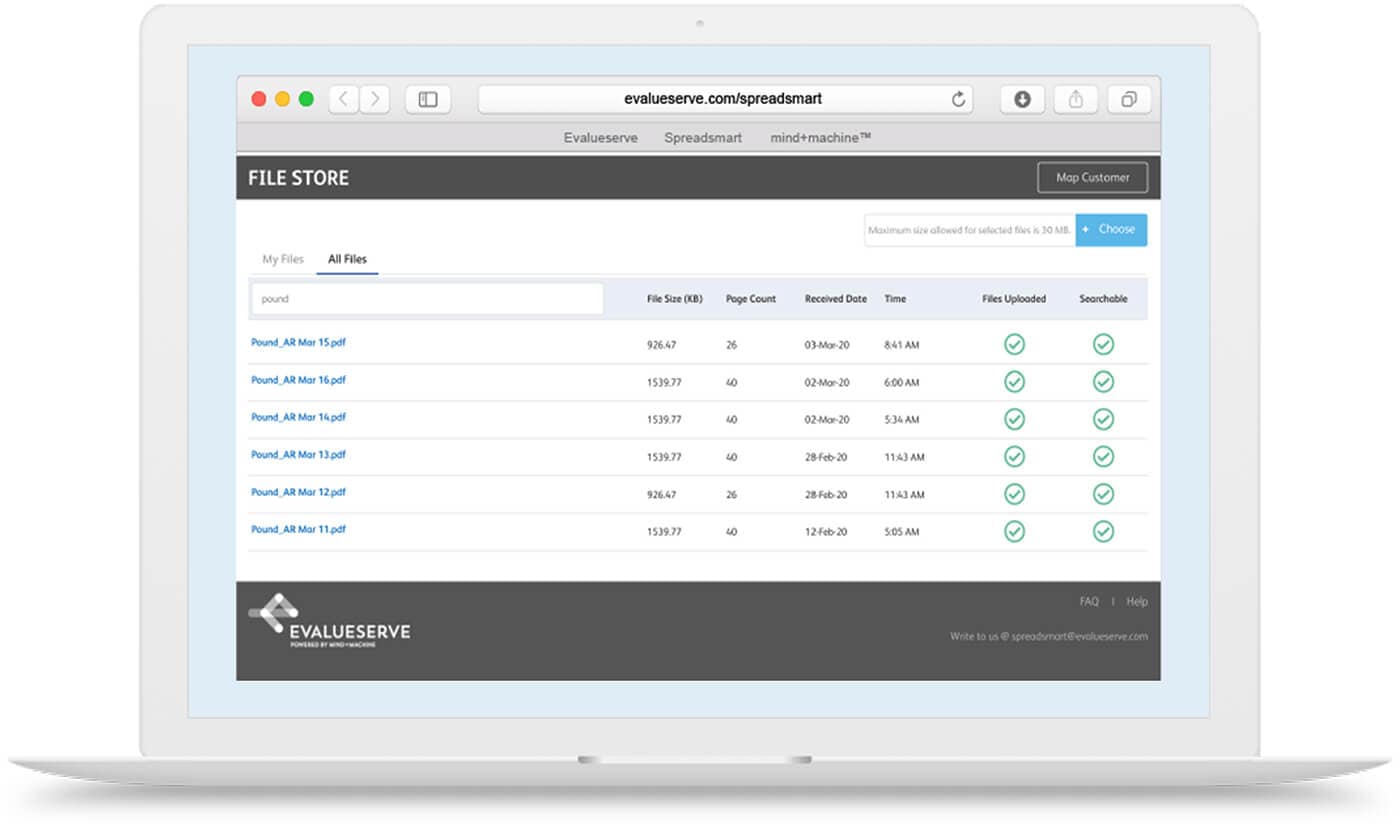

Spreadsmart is an AI-powered financial spreading tool that replaces conventional manual data entry processes with automated data extraction to configurable templates. Our web-based platform leverages a combination of patented mapping technology, AI, OCR, custom algorithms, and ML/DL models to achieve a 70+% efficiency vs manual extraction with a near 100% final output accuracy.

Spreadsmart supports PDF, JPEG, PNG, TIFF, scanned low-resolution, and Excel document types in multiple languages, ensuring maximum flexibility and ease of use for your lending team.

With Spreadsmart, you can achieve faster loan approvals and more accurate credit risk assessments, enabling your lending institution to improve efficiency and profitability. Say goodbye to time-consuming manual processes and hello to the power of AI with Spreadsmart.

70% faster data extraction of financial statements.

Extract data from scanned low-resolution documents.

Flexible and configurable to off the shelf platforms and client’s own models.

Our Advantage

Delivering Results

Faster Speed

Reduced Costs

Model Accuracy

Faster Data Extraction

Automates process of data extraction from structured and non-structured financial reports to a customized output template by using mind+machine™ approach

- 70% faster data extraction from financial statements; overall reduction in time taken for credit risk assessments, financial modeling and due diligence processes

- Ability to extract financial data from native PDF, scanned PDF, and MS Excel in multiple languages.

- Reduces time spent on quality assurance of extracted data points by 15% due to seamless online and offline auditing.

High Accuracy

- Powerful OCR technology handles scanned and low-resolution documents, resulting in 99.6% data accuracy.

- Proprietary algorithms adapt to the client’s needs, and further improve the overall data accuracy.

- Enables setting up of custom rule sets for treatment of financial line items to increase consistency in the credit process.

Seamless Integration

Built-in API’s to easily communicate with any system for import or export of data i.e seamless integration.

- Designed to integrate efficiently with other platforms and customized models, without needing to commit to a massive overhaul.

- Both on-premise and cloud-based solution deployment options are available, regardless of the size of the organization.

Covenant Tracking and Monitoring

Supports covenant category creation, custom covenant formula creation, tracking covenant basis defined frequency, automatically calculates covenant value from spread data.

If a company is breaching any covenant provides an option to generate pre-defined breach letters to the customer automatically.

MIS reporting

Spreadsmart also has a comprehensive reporting module useful for MIS / governance purposes as well as for tracking customer and spread data.

It has a dedicated section for audit reports given the critical nature of data being handled.

Key reports include customer details, user details, taxonomy report, maker checker log, and technical exception report.

Reference Case

Leading Global Bank Transforms Lending Operations

The Wholesale Credit and Lending Team at a top global bank faced inefficiencies and errors in their lending operations due to manual spreading. With the implementation of Spreadsmart, we helped the client accelerate financial spreading and eliminate human errors for faster, more accurate lending decisions.

Related Resources

Optimize your outcomes.

Evalueserve Partners with Newgen to Expand Tech-Enhanced Lending Services

Evalueserve and Newgen announced a new partnership to offer end-to-end credit decisioning support through technology-enhanced expert services.

Financial Spreading – Challenges and Solution

Banks and financial institutions are facing an uphill task of efficiently managing their ever-growing bundles of financial data in multiple and complex formats.

Is it Time to Get Rid of Excel?

Microsoft Excel has dominated the financial services industry for the last 20 years as the go-to tool for calculations, data analysis, and reporting.

Accelerate Credit Approval with AI-Powered Financial Spreading

We helped a major US bank transform the productivity and accuracy of their financial spreading process with our patented financial spreading software, Spreadsmart.

- Solutions for Financial Services

Related Industries

Additional Industries.

Investment Banks

Corporate & Commercial Banks

Asset & Wealth Management

Spreadsmart

Request a Custom Demo.

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.