The increasing emphasis on environmental, social, and governance (ESG) stewardship is transforming the corporate world, with the concept of double materiality at the heart of this paradigm shift. With intensifying regulatory scrutiny and growing investor demand for sustainable investments, asset managers (AMs) face increasing pressure to integrate ESG factors into their investment processes. To navigate this evolving landscape, AMs must adapt their investment strategies to incorporate double materiality principles for various reasons, including enhanced risk management, alignment with evolving regulations, investor and stakeholder demand, value creation and opportunity identification, competitive edge, and, most importantly, long-term portfolio resilience.

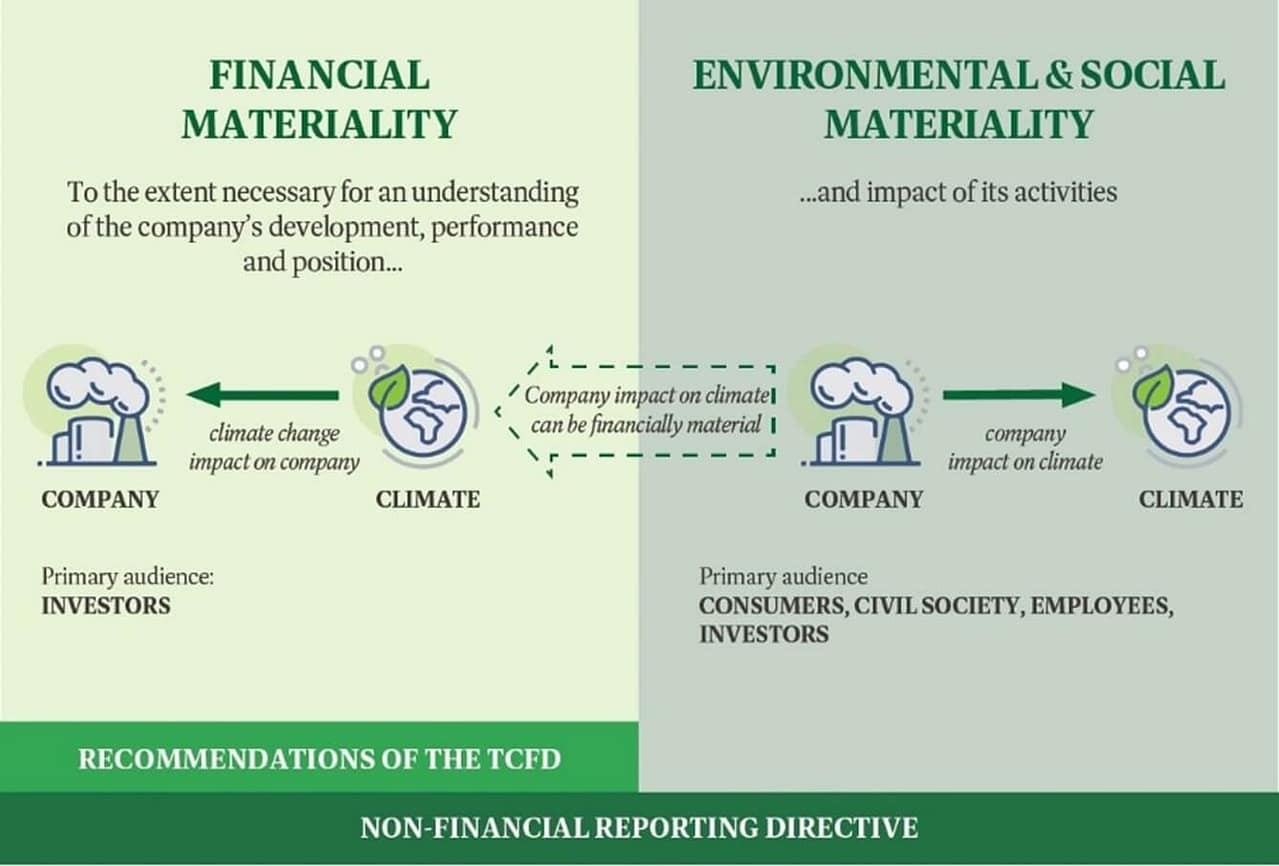

Double materiality is a framework that requires companies to disclose both financial and non-financial information. This means companies must disclose not only how sustainability issues impact their financial performance (financial materiality) but also how their operations affect the environment and society (impact materiality). By mandating the disclosure of both financial material and the impact of material ESG factors, double materiality helps curb greenwashing and fosters genuine environmental stewardship, thereby encouraging companies to transition towards net-zero emissions and adopt sustainable business practices.

Double materiality assessment plays an imperative role in an organization's ESG strategy and prioritization of its initiatives, such as climate change mitigation, social impact, governance and ethics, and product sustainability. It focuses on two key areas:

- How ESG issues affect a company (outside-in perspective): Understanding how external ESG issues (like climate change) can impact a company’s business or financial performance / value.

- How a company's actions impact ESG issues (inside-out perspective): Recognizing a company's operational influence on the environment and society.

It was introduced by the European Commission (EC) in 2019 and has gained prominence in sustainability reporting, thanks to recent developments by the International Sustainability Standards Board (ISSB). The ISSB has incorporated double materiality principles into its global sustainability standards, further solidifying its importance in the global sustainability landscape.

The ISSB recommends and guides firms to report sustainability-related risks and opportunities, with a focus on financial materiality – sustainability factors that impact a company’s financial position. On the other hand, the CSRD requires firms to disclose the impact of corporate activities on the environment and society. Together, these aspects – financial and impact materiality – yield a ‘double materiality’ lens.

The EU Green Taxonomy and Guidelines on Reporting Climate-Related Information emphasizes double materiality as the basis of comprehensive non-financial information disclosure. Leading frameworks like the Global Reporting Initiative (GRI) and the Value Reporting Foundation (including SASB and IIRC) have integrated principles related to double materiality, indicating its growing acceptance as an industry standard. This implies that all major sustainability reporting organizations are now in tandem with benchmark reporting standards.

Double Materiality in Non-financial Reporting Directive: Reporting Climate-related Information

Both AMs and corporations recognize the importance of double materiality and are integrating or planning to integrate it into their reporting and investment strategies. Recent industry reports, surveys, and key developments indicate that AMs are progressively adopting double materiality principles.

- Morningstar’s ‘The Voice of the Asset Owner Survey 2024’ found that asset owners are increasingly prioritizing financial considerations in ESG assessments, with 59% considering double materiality relevant. Larger asset owners were more likely to select double materiality as ‘very relevant,’ indicating its importance in a broader investment scenario.

- ISS’ ESG Corporate Rating Survey, released in February 2024, found overwhelming support for double materiality. Both investors (71%) and industry professionals (81%) deemed it highly relevant to sustainability reporting.

- In June 2024, BNP Paribas Asset Management announced that it would consider voting against companies that fail to provide comprehensive double materiality assessments in line with the CSRD.

- Fidelity has integrated the ‘double materiality’ approach into its sustainability ratings, providing analysts with a more comprehensive view of a company's overall sustainability profile.

- DWS Asset Management considers double materiality as a means of achieving a ‘gold standard’ in sustainability reporting.

Importance of Double Materiality for AMs

Here are some key benefits of double materiality for AMs:

- New investment opportunities and enhanced returns: AMs can identify companies excelling in sustainable business practices and engage with various stakeholders, leading to potential new investments and improved returns.

- Identifying and mitigating ESG risks: By assessing the financial impact of ESG factors, AMs can anticipate emerging risks, which can help them to better manage portfolio risks.

- Alignment with investor demand: Double materiality helps AMs create investment products that align with investor preferences for sustainability while generating attractive returns.

- Regulatory compliance: Many jurisdictions are introducing regulations focused on double materiality. By investing in companies adhering to these principles, AMs can build a robust and responsible portfolio.

Despite its potential, the adoption of double materiality principles has been slow. A large accounting firm’s inaugural Global CSRD Survey revealed a significant gap between corporate confidence and preparedness. Although 72% of companies facing the first CSRD reporting deadline in 2025 express high confidence, progress on key activities is lagging, with only 38% having completed double materiality assessments.

Challenges Posed by Double Materiality

Double materiality presents numerous challenges and has sparked significant debates, primarily due to its vague and unspecified nature. Even if organizations like the ISSB aim to incorporate and implement double materiality, it may face strong opposition, particularly in jurisdictions that are still struggling with basic sustainability reporting.

- Elusive materiality definition: A significant hurdle in implementing double materiality is the lack of a clear definition. Traditionally focused on investor impact, there is growing pressure to consider the broader societal implications of ESG factors. However, determining which societal impacts are sufficiently material remains challenging due to the subjective nature of this assessment. Different organizations may prioritize and interpret distinct ESG factors, leading to inconsistent reporting. This subjectivity undermines the comparability and reliability of sustainability information.

- A Global CSRD survey also revealed that companies are struggling to effectively implement double materiality, particularly in identifying and prioritizing material issues. Before applying a materiality threshold, a significant number of companies (52%) evaluated over 40 impacts, risks, and opportunities (IROs), and 23% were unsure or declined to answer. This highlights the complexity of the process and the challenges companies face in effectively narrowing down the scope of their analysis.

- Lack of standardized approach: A consistent framework for double materiality is currently lacking, and there is no universally accepted specific guidance on how companies should execute this. This inconsistency poses challenges for businesses and investors alike as they navigate sustainability reporting and investment decisions.

- Audience misalignment: Another challenge arises in determining the primary audience for sustainability disclosures. While financial reports traditionally target investors, the broader scope of double materiality encompasses a diverse stakeholder group. This mismatch between the complexity of financial data and the needs of a wider audience creates difficulties in crafting effective disclosures.

- Data quality and consistency: AMs face significant hurdles in leveraging sustainability data for analysis due to its frequent incompleteness and subjective nature. This makes quantitative analysis and benchmarking challenging.

- According to the Global CSRD survey, data quality and availability emerged as the most pressing challenge, cited by 59% of respondents.

- Enhanced due diligence and integration into the investment process: AMs need to go beyond financial metrics to assess a company's ESG performance and its impact on stakeholders, which is challenging. Incorporating double materiality analysis into investment decisions requires robust methodologies and tools.

- Significant resources: Implementing double materiality analysis into investments requires substantial financial investments, including technology and human capital, which will not be easy for all AMs.

- Existing greenwashing concerns: Greenwashing makes it difficult to identify truly sustainable companies as it makes it difficult to verify sustainability claims and assess reputational risks, and can lead to increased due diligence costs, investor backlash, and a competitive disadvantage.

- A 2023 RepRisk survey revealed a concerning trend – one in four climate-related corporate ESG claims amounted to greenwashing.

- The financial services sector, particularly banks, witnessed a surge in greenwashing activities, with a 70% increase in such incidents in 2023. Although 2024 saw a 20% decline in such incidents, there was a 30% increase in ‘high-severity cases.’

Successful Implementation of Double Materiality

Overcoming the challenges of implementing double materiality requires a multistep approach for organizations. While specific steps may vary, there are some universal best practices to consider:

- Identify compliance needs: Reporting obligations vary based on company size, industry, and location. To ensure compliance, identify specific regulations for financial and non-financial disclosures. This will help determine material and non-material issues.

- Conduct a double materiality evaluation: This step helps identify key environmental and social impacts, risks, and opportunities specific to an organization, laying the groundwork for an effective ESG strategy.

- Capture double material methodology: Adherence to double materiality frameworks requires a detailed roadmap that outlines implementation plans, resource allocation, and performance metrics. This often involves stakeholder engagement, data collection, analysis, and research. Maintaining comprehensive records is also crucial.

- Gather and report accurate and comprehensive data: Engage with stakeholders, leverage expert knowledge, utilize existing assessments, conduct thorough research, and employ data analysis tools to gather comprehensive data.

By focusing on these aspects and taking a multifaceted approach, a firm can build a robust data foundation to formulate its sustainability strategy.

While double materiality offers the potential for corporate accountability and societal progress, its impact depends on its purpose. If used for risk mitigation and financial optimization, sustainability reporting may become superficial. However, if it is used as a robust indicator of corporate responsibility, it can drive meaningful change. Government and regulatory bodies play a crucial role in driving effective sustainability reporting. While standards like the ISSB are important, rigorous implementation is essential to ensure companies are held accountable for their influence on all stakeholders.

In conclusion, realizing this transformation requires a collaborative effort that exceeds financial considerations. Not only that, incorporating ESG factors and engaging all stakeholders, including regulators, is essential, as finance alone cannot drive the necessary change.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.