Generative AI has the potential to revolutionize the way financial institutions operate. Banks are heavily investing in artificial intelligence to address challenges brought on by the recent pandemic and ongoing economic downturn. But can generative AI in lending truly be a game changer?

“AI is not a threat to traditional banking; it is a catalyst for its evolution.”

— Sundar Pichai, CEO of Google

Whitepaper

Transform Lending with AI and Automation

Potential

Banks have been at the forefront of adopting cutting-edge technologies. Among them, generative AI-powered chatbots like ChatGPT are poised to reshape the lending landscape. Here’s how utilizing generative AI in banking can be a game changer:

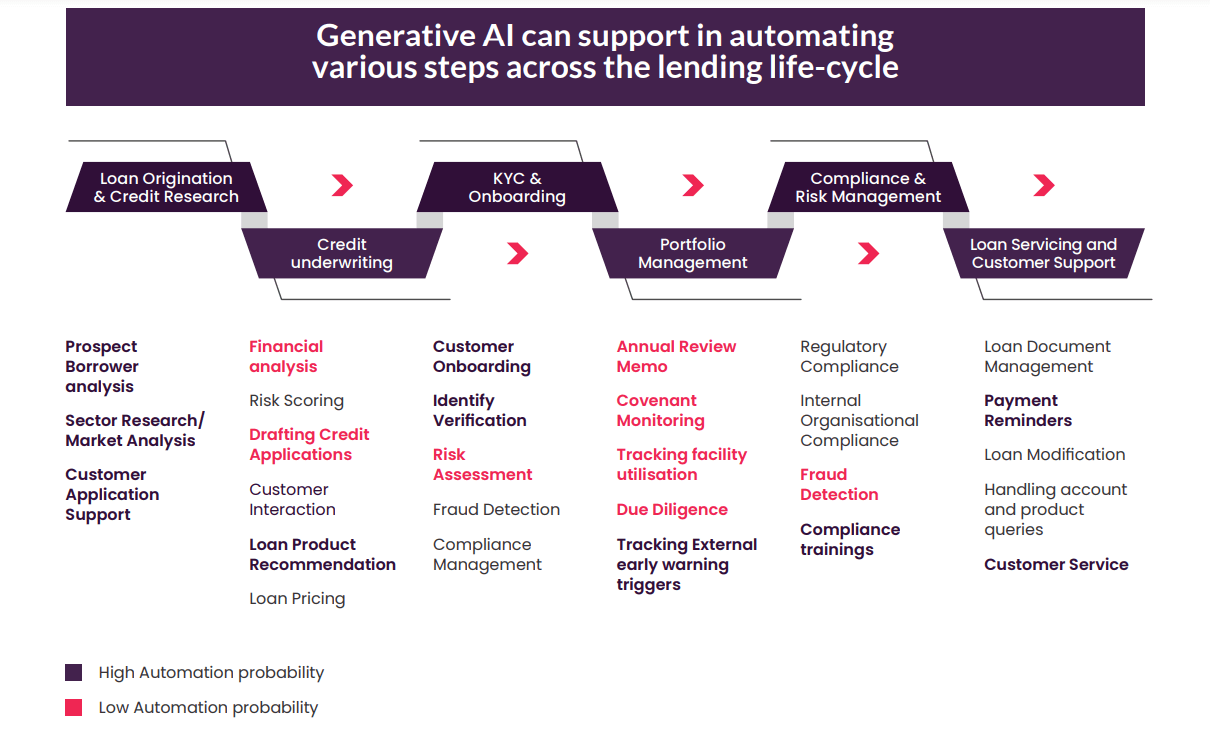

Automating the Lending Life Cycle

When deployed in an environment with adequate risk management, generative AI can provide the capability for faster, risk-based credit decisions by automating time-consuming tasks.

Based on our initial analysis, we have charted the overall impact of generative AI across the lending journey.

Providing Recommendations

Generative AI can assist bankers by analyzing data and providing personalized recommendations. Specifically, loan underwriters can use generative AI to automate certain sections of credit memos such as:

- Executive summary

- Business description

- Historical financial high-level analysis

- External risk rating analysis & news tracking

- Sector analysis, etc.

Enhancing Customer Service

AI-based chatbots provide 24/7 support, personalized assistance, and quick responses to customer queries. This improves accessibility, transforming the lending industry into a more efficient and customer-friendly space.

Limitations

Generative AI holds significant potential as a valuable asset in the banking industry. There are, however, 5 limitations that banks need to be mindful of.

- Generative AI still requires significant testing to address accuracy errors.

- Banks must consider the costs to integrate, train, and deploy generative AI while maintaining operational costs and keeping up with regulator costs.

- While the creators of generative AI have taken immense measures to ensure the security and privacy of users, banks need to take additional steps to protect their customers.

- Automation reduces the need for human labor, potentially frustrating individuals that prefer human interaction.

- Generative AI is an incredible tool but can never fully replace human expertise. Relying too heavily on generative AI can lead to dependencies that may result in oversight and decision-making errors.

The implementation of generative AI in banking has created a need for comprehensive AI compliance, requiring domain expertise to address these potential gaps. Evalueserve can partner with clients to deliver robust credit research and test AI solutions to meet their needs.

Evalueserve’s expertise helps lenders streamline portfolio monitoring with end-to-end solutions. Click here to learn more about how our lending services can transform banking operations.