Executive Summary

Loan servicing is a crucial aspect of effective loan management, bridging the gap between lenders and borrowers in navigating the complexities of the loan market. As this market expands and evolves, understanding loan servicing dynamics is essential for financial institutions to remain competitive. Outsourcing has emerged as a strategic tool for institutions to manage costs and streamline operations, particularly in non-core lending activities. By effectively navigating loan servicing and outsourcing strategies, lenders can enhance efficiency and deliver an exceptional experience to borrowers.

In this article, we delve deep into the nuances of loan servicing, exploring key components such as borrower risk profiles, diverse loan categories, and the associated regulatory landscape. We also investigate the rising trend of outsourcing within the industry, analyzing how institutions leverage third-party expertise to optimize processes and enhance overall performance. Additionally, we will highlight how Evalueserve's technology-driven solutions empower lenders to navigate the intricacies of loan servicing, enabling them to stay ahead in a dynamic and competitive market environment.

Overview of Loan Servicing

The loan landscape is diverse, offering borrowers a range of financing options across different markets and lenders. Banking lenders, such as commercial, corporate, and business banks, cater to a broad spectrum of borrowers, from large corporations to commercial entities in primary and secondary markets. They provide various loan types like bilateral and syndicate loans ranging from small to high-ticket size loans, often involving comprehensive underwriting processes to assess borrower income and business profiles.

Non-banking lenders, such as private lenders, credit unions, mortgage financiers, auto dealer financiers, equipment financiers, and leasing companies, serve individual buyers and small businesses. They primarily offer bilateral loans in the primary market, focusing on smaller ticket sizes with quicker turnaround times based on borrower profiles and creditworthiness.

Understanding borrowers' risk profiles is paramount in making a lending decision. Banking lenders adhere to stringent regulatory requirements, limiting their exposure to high-risk borrowers. In contrast, non-banking lenders may take on higher-risk profiles, leveraging asset-based or collateral-based lending strategies.

After a loan is approved and disbursed, loan servicing activities become critical. Loan servicers manage borrower-lender relations and ensure the smooth operation of loan accounts. Key activities within the loan servicing value chain include:

- Loan Set-up (including rollover): Setting up loan screens for new/refinanced loans (Loan amount, interest rates, repayment terms, purpose, exception details, etc.)

- Payment Processing: Processing monthly payments, ensuring accurate application of principal, interest, and fees

- Account Management: Maintaining and updating borrower information, loan details, and loan modifications (ROI Change, Terms, etc.)

- Customer Service: Handling inquiries, addressing concerns, and providing required information (e.g., Loan Repayment Schedule, provisional certificates)

- Delinquency Management: Mitigating default by reaching out to borrowers, offering loss mitigation options, and initiating foreclosure proceedings as required

- Escrow Administration: Managing funds held in escrow and ensuring timely payment of essential expenses related to the loan, such as property taxes and insurance

- Payoff and Loan Closure: Closing the loan account, issuing NOCs, and releasing any liens or collateral

- Record Maintenance and Documentation: Record-keeping and documentation of loan agreements, communications, and legal docs

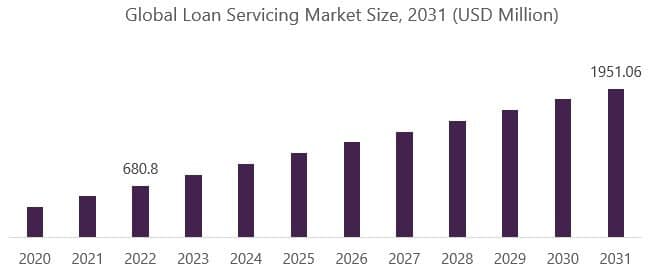

The global loan servicing market is experiencing robust growth and is projected to reach USD ~2bn by 2031, with an impressive CAGR of 11.0%. This growth is fueled by various factors, such as rising demand for financing, advancing digitalization, increasing reliance on financial institutions, and widespread use of the internet and smartphones.

Source: www.businessresearchinsights.com

Loan Servicing – Outsourcing Landscape

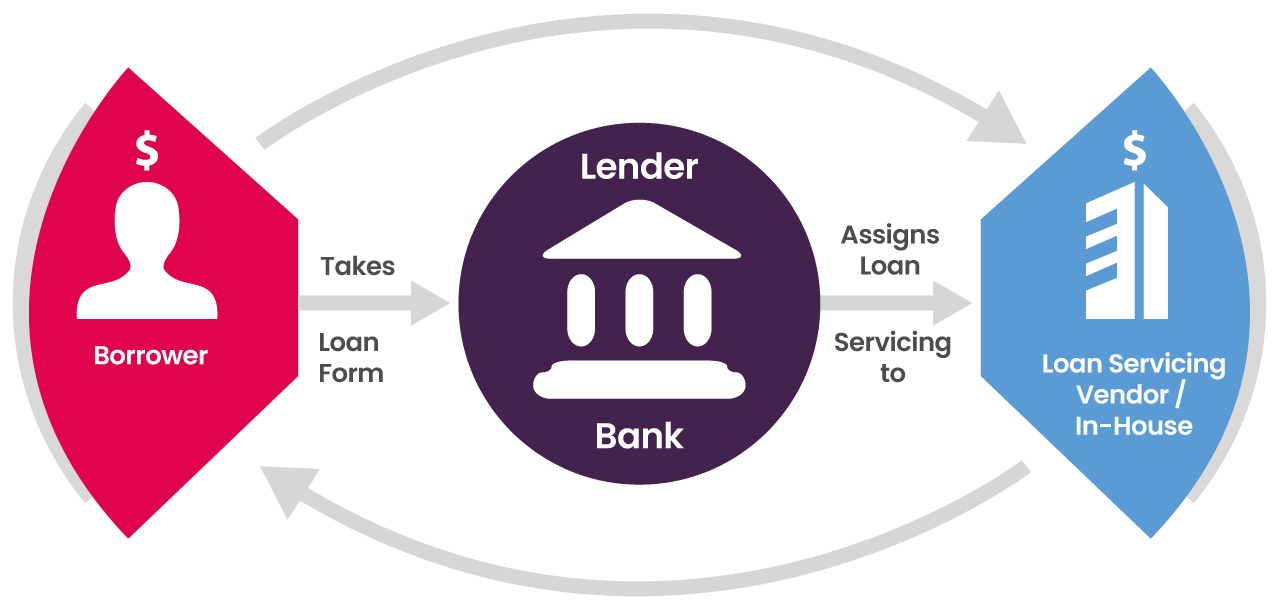

Outsourcing loan servicing has become prevalent among financial institutions for effective loan management, covering activities essential for managing borrower-lender relationships and ensuring smooth loan operations throughout the lifecycle, from origination to closure. Banking lenders outsource loan servicing activities for cost optimization, peak load management, and managing high complex activities in-house. In contrast, non-banking lenders outsource primarily because they lack enough resources to have an in-house loan servicing department and focus on core lending activities. This approach allows lenders to leverage third-party vendors' expertise for specific tasks, enhancing overall efficiency. Further, Banking lenders sometimes act as agents in syndicate financing, managing overall loan servicing activities (in-house / through third-party vendors) on behalf of all participating lenders.

Banking lenders often outsource high-volume, well-defined tasks such as repayment processing, account management, and record-keeping, allowing them to focus on core lending activities. Additionally, they may maintain in-house or "captive" servicing set-ups for sensitive functions like loan disbursement, regulatory compliances, and investor reporting, ensuring tighter control over these critical areas.

Non-banking lenders, such as private lenders, credit unions, mortgage financers, auto dealer financiers, equipment financiers, and leasing companies, often lack in-house capabilities to manage the entire loan servicing lifecycle. Therefore, they are more likely to outsource most servicing tasks to nearshore or location-based vendors, allowing them to focus on their core lending activities (growing lending books).

The decision to outsource loan servicing activities is not a one-size-fits-all approach. Certain loan servicing activities, such as specific tasks in loan origination and rollover, payment processing, loan modification, and account reconciliation, have high outsourcing potential due to their standardized, data-driven nature. Specialized vendors with expertise in automation and technology can efficiently handle these tasks. Conversely, activities like loan application review, loan disbursement, and regulatory compliances are typically retained in-house due to their sensitive nature and complex regulatory requirements.

While outsourcing offers significant advantages, it is essential to acknowledge that outsourcing also introduces certain risks, particularly for banking institutions. Due to the larger ticket sizes associated with their loans, banks pose a higher potential for financial and reputational loss if outsourcing decisions are not carefully considered. Non-banking lenders with smaller loan portfolios and specialized servicing arrangements generally experience lower outsourcing risks.

In essence, outsourcing loan servicing is a strategic decision that allows lending institutions to focus on core competencies and achieve cost savings, delivering a more streamlined and efficient loan servicing experience for their customers.

Technology in Loan Servicing

Technology plays a crucial role in loan servicing in today's fast-paced financial environment. Advanced platforms such as LoanIQ, ACBS, and AFSVision are leading loan servicing solutions widely used by banks and financial institutions. These platforms offer a comprehensive suite of functionalities for managing loan portfolios, including loan origination, servicing, reporting, and portfolio management. They can integrate seamlessly with other banking and financial systems, facilitating smooth data flow and process optimization. Their automation capabilities streamline processes, reduce manual intervention, mitigate operational risks, improve productivity, and enhance regulatory compliance. Additionally, these tools provide valuable insights through real-time reporting and analytics, aiding in strategic decision-making.

Whitepaper

Transform Lending with AI and Automation

Role of GenAI in Loan Servicing

Generative AI (GenAI) is transforming the loan servicing industry by introducing advanced automation and intelligent decision-making capabilities. GenAI models can analyze vast amounts of data to predict borrower behavior, assess risk, and personalize loan offerings, enabling financial institutions to proactively manage their loan portfolios and mitigate potential delinquencies.

Critical roles of GenAI in loan servicing include:

- Predictive Analytics: Analyzing large datasets to predict borrower behavior, assess risk, and customize loan offerings.

- Enhanced Customer Service: Automating responses to common inquiries and providing personalized assistance through chatbots and virtual assistants, thereby reducing the workload on customer service teams and ensuring timely and accurate information for borrowers.

- Efficient Document Processing: Automatically extracting and validating information from loan applications and supporting documents, reducing processing time, minimizing errors, and ensuring regulatory compliance.

- Fraud Detection: Identifying unusual patterns and flagging suspicious activities to protect both lenders and borrowers.

Overall, integrating GenAI into loan servicing processes boosts operational efficiency and accuracy, enhances the customer experience, and reinforces risk management.

How Evalueserve Can Help

With over a decade of experience, Evalueserve is a trusted leader in transforming lending operations for corporate and commercial banks. Our comprehensive services cover every aspect of the loan lifecycle, providing end-to-end support from origination to underwriting, monitoring, servicing, and closure activities.

Leveraging cutting-edge AI and automation technologies, we streamline loan servicing operations, ensuring compliance with regulatory standards and enhancing borrower experiences. Partnering with Evalueserve means accessing a wealth of expertise to optimize your loan management processes and achieve operational excellence.

Here’s how Evalueserve can help you in loan servicing activities:

- Loan Set-up: Loan onboarding into loan management system (loan, amount, interest rates, terms, purpose, etc.) and facilitating smooth initiation of loan processes

- Loan Servicing: Payment processing, loan modifications, loan rollover/structuring, account management, account reconciliation, reporting and documentation, customer service

- Loan Closure: Delinquency management, loan closure activities, collateral release

- Collateral Monitoring: Validating collateral documents, updating collateral details on lending platforms, managing collateral amendments

At Evalueserve, we are committed to providing innovative solutions that streamline loan servicing operations and drive unparalleled efficiency and compliance in the dynamic banking landscape.

Learn More about our Lending Services by visiting our webpage.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.