In 2020, the global mining industry witnessed only one-third the number of M&A deals it had signed a year ago. The biggest reason was the COVID-19 pandemic. Disruption in business activity in the first half of the year led to a limited pipeline of new projects under development and/or put into production. Another reason was the lack of large deals, following consolidation by some of the mining majors in the last couple of years.

Present M&A Landscape

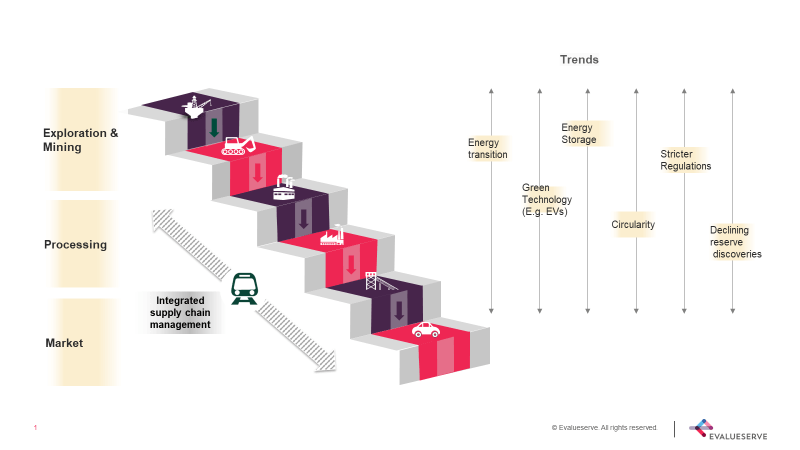

The industry is witnessing an upswing on the back of ongoing global economic recovery and premium commodity prices, driven by consumers’ shift to greener technologies and infrastructure. To make the most of these growth opportunities, mining companies are considering deals that would help them achieve long-term synergies and value enhancement. Our exhaustive industry assessment across the value chain, highlights the overarching trends influencing recent strategic M&A activities

Emerging Trends

The use of new metals in green technology has altered the demand dynamics of the sector. To fully capitalize on this unlocked market potential, mining companies are strategically strengthening their portfolios.

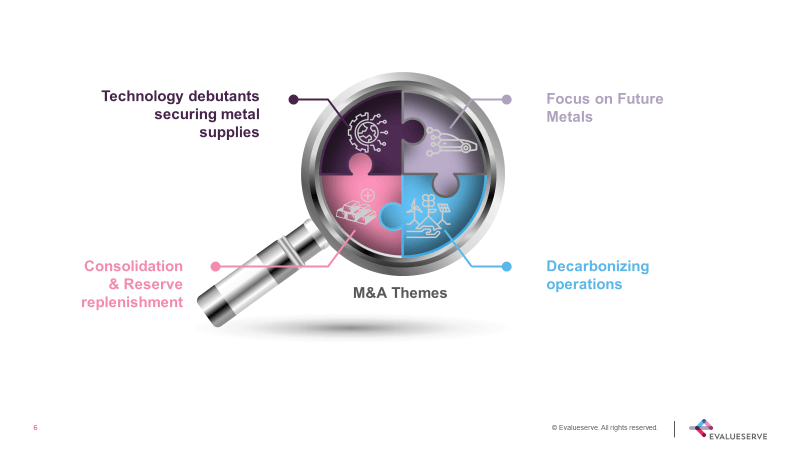

Our analysis of recent deals and industry trends show that M&A activities will remain within the following thematic boundaries:

Thematic Insights

Focus on Future Metals

By 2040, almost 60% of new vehicle sales and about a third of the cars on roads will be electric. This trend will push up the demand for metals essential for the industry such as lithium and cobalt. Mining companies are already pursuing M&A or are acquiring assets to ensure a sufficient share of these ‘future metals’ in their portfolios. For example, precious metals miner Sibanye Stilwater has entered the battery metals market through an investment in Finnish lithium producer Keliber Oy. As Europe is rapidly becoming a hub of electric vehicle battery manufacturers, Keliber’s operations in Finland offer advantages such as quick transport of lithium hydroxide to European customers. Another mining major, Anglo Pacific, has acquired a share in cobalt production from a mine in Canada owned by Vale, a Brazilian metals and mining company. The move is to reposition the business towards 21st-century commodities and become a battery metals-focused company.

Mining companies are striving to transform their product portfolio and align with the demand dynamics of the future.

Decarbonizing Operations

The journey towards net-zero emissions is illustrated by major miners’ focus on reducing greenhouse gas (GHG) emissions and achieving carbon neutrality for 100% of their portfolio by 2050 or sooner. Amid growing pressure from environmental activists and investors, an increasing number of mining companies across the globe are working on two fronts: 1) Divesting high carbon-emitting assets and 2) Using renewable energy sources. Our industry analysis has identified that mining companies are divesting coal assets to optimize their asset portfolios and shying away from investing in any new thermal coal development projects amid concerns over climate change.

Mining companies are moving towards minimizing their stake in high carbon-emitting commodities (e.g. coal) and optimizing resource utilization through circularity and adoption of new technology.

Vale has joined the likes of BHP and Anglo American by taking steps towards exiting the coal industry. The company aims to become carbon neutral by 2050. It has already signed a deal to take full control of its Mozambique business, which produces both thermal and metallurgical coal. The company plans to begin the process of finding a buyer as soon as the transfer is complete. Another recent example is South 32, which divested its coal business in South Africa. The move comes at a time when many banks and insurers are scaling back financing for the sector because of global warming concerns. The company’s decision to exit the coal business is in line with its strategy of re-shaping its portfolio of base metals.

Consolidation and Reserve Replacement Strategy

Amid high commodity prices, declining reserve discoveries, and focus on future metals, many mining companies are using consolidation as a critical tool to reshape their portfolios and strategies. Given the abundance of outbound investment opportunities, cash-rich mining players are spinning off and divesting their non-core assets and using the money to fund strategic growth targets.

A prime example is Endeavour Mining’s acquisition of Teranga Gold. With this acquisition, Endeavour will be placed among the top 10 global gold producers. The deal will help the company consolidate its position as the largest gold producer in West Africa’s highly prospective and under-explored Birimian Greenstone Belt. Another example of consolidation is Strike Resources plan to spin out lithium and graphite assets. The company aims to create a distinct battery minerals entity that would focus on the exploration and potential development of battery minerals assets. The move will allow Strike to concentrate its efforts on core iron ore assets.

Declining reserve discoveries, high commodity prices, and focus on future metals will continue to drive consolidation in the mining industry. Players with deep coffers will capitalize on this opportunity for strategic acquisitions.

Technology Debutants Securing Metal Supplies

Technology companies are worried about the future supply of essential commodities and have stepped up their efforts to acquire stakes in mines. Our market intelligence study reveals how metals and mines-related deals, investments, and partnerships are growing in a bid to secure long-term supply across the globe. The trend is also benefitting mining companies, as they are gaining long-term buyers.

Contemporary Amperex Technology (CAT), a China-based battery maker, recently announced a plan to purchase a stake in China Molybdenum Co’s Kisanfu copper-cobalt mine in the Democratic Republic of Congo. The move will help CAT secure a long-term supply of cobalt.

Future supply concerns will drive green technology leaders to increase their investment/controlling interest in fully integrated mining operations.

Evalueserve undertakes an exhaustive assessment of the entire mining value chain to identify trends and developments that influence M&A activities. Solutions to cater to the needs of mining companies are:

To learn about these solutions, speak to an expert here.