A well-known Brazilian author Paulo Coelho said – “Everything in life has its price”, which is true for everything – tangible or intangible. When discussing the intangible, patents are an obvious asset. Inventions are known to be key catalysts for companies to remain progressive and competitive. Companies set aside a substantial R&D/innovation budget to protect ideas in the form of patents, monetize through licensing or sales and build their brand value as well.

Despite exorbitant investments in patents, only a small fraction of a company’s total patent portfolio are utilized for monetization. In our previous blog, we learned how to build a smart patent portfolio and how smart patent portfolios bring various benefits to the patent owner. One of the key benefits of owning a smart portfolio is improving and maintaining the quality of patents, and in turn, increase the value and probability of patent monetization. Now, when a company owns a smart patent portfolio and wants to monetize the patent by selling, licensing out, or utilizing any other means of monetization, they need to know exactly how much the patent/portfolio is worth. I wish there was a system where we input the patent number and then get the dollar value that one can expect from the patent. Until we get such a tool, let’s understand how and why a patent can be worth thousands or millions of dollars.

Valuing a patent is a complex and subjective assessment. Currently, there are some different approaches used to assess the value of a patent such as the Cost Approach, Income Approach, and Market Approach. Although each approach is largely dependent on the type of patent transaction, the Market Approach is one of the most commonly used ones to estimate a base dollar value or damage appraisement in case of infringement detection.

Similar to tangible items such as cars, phones, and houses whose market price is carefully calculated through a variety of different factors such as labor cost, overhead cost, market dynamics, product uniqueness, and competitor’s position, patent value is also calculated using a number of different factors like:

- How important and critical is it for a specific technology domain.

- What is the expected dependency of available products on the patent?

- Is the patent protecting a new technology?

- Is the patent protecting an essential aspect of mature technology?

- Is the patent becoming obsolete and overtaken by another technology?

- Is the patent application limited to a specific application area?

- Is there any lateral technology available to solve the same problem, ease of placement?

- How big is the applicable industry?

- How crowded is the IP within the specific technology domain?

The answer to any of the factors above can fluctuate throughout the life of a patent, which can raise or diminish the value of the patent at any point in time. Therefore, it is important for portfolio managers to proactively scan the patent portfolio and look for relevant patents that they can monetize at the right time. Imagine a patent as a “reward card” with an unknown value that is better utilized at the right time and place before the validity expires.

What is the value of the intangible reward card?

There are different ways and methods one can assess the value of a patent, we just need to be sure that the factors and corresponding assigned weightage are logical and make sense to value your invention. There are valuation models that consider hundreds of factors/data points in complex formulas to come up with a dollar value, however, the basic concept behind these astronomical valuation processes remains the same. What varies is the data and information being used for valuation depending on the industry, since publicly available information can vary for each industry. The key is to assess how critical your invention is for the overall technology/industry and what would it take to be replaced.

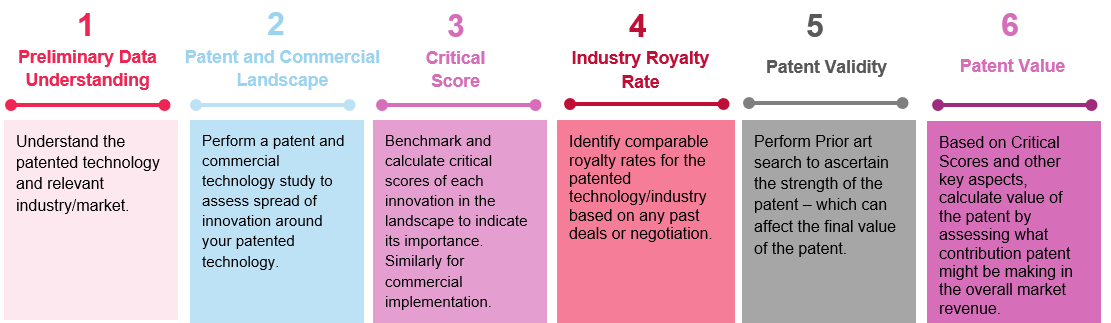

Below is a high-level flow chart depicting key steps for valuation assessment.

Think of a public company, whose stocks/shares are with the public and other entities associated with the company. Different entities inject and contribute investments to the public company by purchasing stocks. Although everyone who owns the stock of a company is a partner, not everyone can control the company and make decisions. Decisions are made by majority stockholders (critical entity), i.e., individuals who contributed the most investment in the form of stock purchase and own maximum shares/stocks. Following this analogy, a technology market is built based on the contribution of different innovations/patents and eventually commercial products in the market. If we can assess a critical score of a patent in a specific technology market, then it can help reveal if a patent is a critical entity or not. If dependency of a technology market is high on a patent, then the critical score of the patent will also be high and therefore the patent value will rise as well.

For the high-tech industry, where the likelihood of finding the granular market and commercial product information related to the patented technology is high, we can dig additional information that can be used to refine the patent’s value. Considering the commercial angle of the technology market also adds confidence to the overall patent value. Similar to the patent landscape we used to assess the dependency of the market on the patent, we can further assess how available commercial products have implemented similar features and assess another critical score from a commercial point of view. With the commercial critical score, we can refine the probable patent value. Once we have the base value of the patent, we will keep refining the value with more logical factors such as royalty rate, the growth rate of the technology market, etc. to finalize a fair value of the patent.

Another imperative aspect while assessing patent value is the prior art. Why will someone pay for a car without an engine? If the engine (claim) of your patent is not valid then it impacts the value of the patent. Assessing prior art is the key to gaining more confidence in your patent’s value while discussing with the negotiator.

There is no right or wrong value of the patent. It is more about the logic we use to assess different factors that affect the criticality of our patent in a technology market and ultimately reach a fair value of the patent. Further, I recall a famous phrase – “Beauty lies in the eye of the beholder” when thinking about assessing the value of a patent. I may want to sell a patent not relevant for my business and have assessed value to be $200,000 USD, however, someone may want to pay a premium for my patent because he finds my patent key for his company/product. Therefore, the patent value we get from these astronomical valuation methodologies is just the base of discussion for negotiating a patent transaction, not the real assurance.

Related Resources