In this publication, we explain the Atypical challenges that come from adopting ESG in the index industry. We also discuss why this is not just a green initiative, but how it goes much deeper and into many other aspects of organizations. we dive into the complexity and diversity of an ESG ecosystem and why index providers need to be on top of the changes if they want to continue in the market.

What is ESG?

ESG is at the forefront of investor decision-making worldwide. While ESG investing as a concept has been around for decades, it has picked up momentum in recent years. The global ESG AUM is expected to reach USD 53 trillion in 2025 compared to USD 37.8 trillion in 2019, with over 3,000 Principles for Responsible Investment (PRI) signatories in 2020.

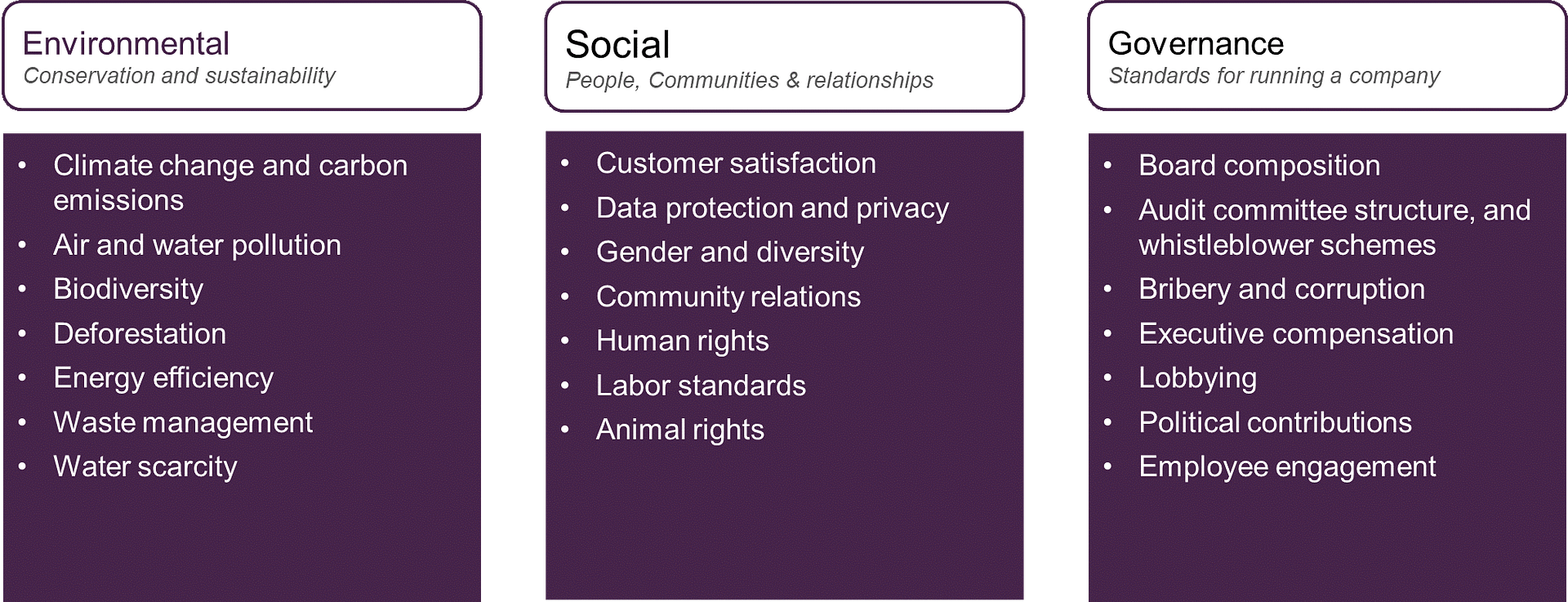

ESG, or Environmental, Social, and Governance (see Figure 1), is the underlying set of “rules or standards” used by conscious investors to screen potential investments and decide if a company that is going to receive their funds is environmentally conscious, socially responsible, and well managed. It is also a way to manage risk in today’s society, where social malpractices can upend the future of an otherwise financially stable company. Pre-pandemic numbers show that in just five years, USD 500bn was wiped off the market as a result of ESG controversies. For example, social media companies are under scrutiny for data protection concerns and giant aircraft manufacturers are being monitored to evaluate if they released their products “too soon”. Investors and fund managers are asking for detailed disclosures before investing, and findings of due diligence are having a real impact on the market value of companies.

Figure 1: ESG Factors

ESG Indexes

The trend in ESG investing is reflected in the ESG indexes as well. In 1990, MSCI launched the first ESG index MSCI KLD 400 Social Index. Currently, there are more than 1,000 ESG indexes worldwide launched by various index players from major index providers such as S&P, MSCI, and FTSE to regional banks. The Index Industry Association (IIA) recently noted that the ESG indexes grew an impressive 40.2% in 2020 vs. 2019. According to consultancy firm ETFGI, ESG exchange-traded funds (ETFs) and exchange-traded products (ETPs) reached a record US$280 billion AUM at the end of May 2021.

The subsequent sections describe the process of constructing an ESG index and the unique aspects of the ESG ecosystem that make providing an ESG index interesting and challenging.

Designing an ESG Index:

The first step is to create a framework to assess the ESG compliance level of a company. This framework comprises defining ESG standards as well as an ESG rating methodology. ESG standards define the methodology for ESG metrics as well as their measurement and reporting. There are more than a dozen standards, including those by third‑party aggregators such as Bloomberg, Sustainalytics, or others. To arrive at the ESG ratings, data for relevant indicators within each of the E, S, and G factors are culled and standardized to create scores for each factor and then aggregated to arrive at an overall score for a company. The weight assigned to each factor is guided by the relative importance of the factor. ESG ratings are calculated and provided by rating firms such as Refinitiv, MSCI, Bloomberg, Sustainalytics, RobecoSam, Truvalue Labs, S-Ray, Fitch, Moody’s, and S&P. Several fund managers also have in-house rating systems.

The next step is to create an ESG index strategy. PRI classifies ESG strategies for investing as follows:

- Screening Strategies

- Negative screening—excludes companies that do not fit the ESG criteria

- Positive screening—includes only companies that rank best on the ESG criteria

- Norms-based screening—includes companies that fulfill minimum standards based on international norms

- Integration Strategies—include ESG criteria as an overlay on regular financial analysis

- Engagement Strategies—engage with companies through measures such proposals, communication, and voting

Indexes use the first two classifications. For Equities-based ESG portfolios, 74% of the total portfolio AUM is invested in ESG integration strategies and 52% in screening strategies.

Working through the Idiosyncratic ESG Ecosystem

High-quality data is key for investment analysis and product creation. The nature of ESG data and factors is inherently subjective, as not all ESG issues are equally significant for the industry. According to Refinitiv, the main challenges in ESG data are quality, timeliness, and relevance. Issues in quality arise when there is a mismatch between the knowledge of financial analysts and that of ESG service providers. Financial analysts have deep industry knowledge but usually require more learning on the ESG front, while ESG service providers usually have a limited understanding of company business models. Timeliness refers to the need to set clear targets that a company intends to achieve and report progress on so that investors can make objective decisions. ESG data also needs to be relevant to an investor’s strategies. Some other data challenges in ESG include availability (limited or not available), consistency, transparency, traceability, and comparability across sectors. Since ESG data is more subjective than objective financial information, substantial data analytics and advanced technologies such as artificial intelligence may be required.

Diverse ESG standards present difficulties for companies when deciding which framework to follow and which parameters to report. This also leads to divergences in ESG reporting standards, scores, and ratings. For example, calculating scores is highly complex considering that each country, region, and industry has different ESG standards and objectives on various ESG factors such as gender parity, child abuse, deforestation, waste management, or pollution.

A study by MIT Sloan found that the correlation among the ratings of six different ESG rating firms was on average 0.54. If true exposure to ESG is not reflected, investor demand and stock performance are affected. Realizing the need to harmonize multiple ESG standards, reporting organizations CDP, CDSB, GRI, IIRC, and SASB presented their intention to create a comprehensive corporate reporting system in 2020.

Divergent standards and ratings affect the strategy selection and performance of ESG indexes. Moreover, as exposure to ESG in an index increase and as more data becomes available, an index provider has to ensure that it is not using an outdated or overly simplistic framework. In a rapidly evolving ESG ecosystem, the challenge for index providers is to design objective methodologies that are transparent, replicable, liquid, tradeable, and in line with changing investor preferences. This is an uphill task for maximum impact investing.

Evalueserve’s Index & Quant division works with financial services clients to support their ESG mandates by offering ESG research services for novel investment products and ESG index calculation and production services.