Introduction

It is abundantly clear that the first milestone of a 43% reduction in greenhouse gas (GHG) emissions by 2030 is requisite to ensure everyone is on the path to meeting the Net Zero 2050 goals, and limiting the global temperature rise to 1.5 degrees Celsius from pre-industrial levels. A significant chunk of the decarbonisation potential to meet these goals is being attributed to nature-based solutions (NBS). In turn, a growing number of NBS projects aligned with forestry and ecosystem protection as well as restoration with the benefit of carbon removal and sequestration are being listed on the voluntary carbon market (VCM).

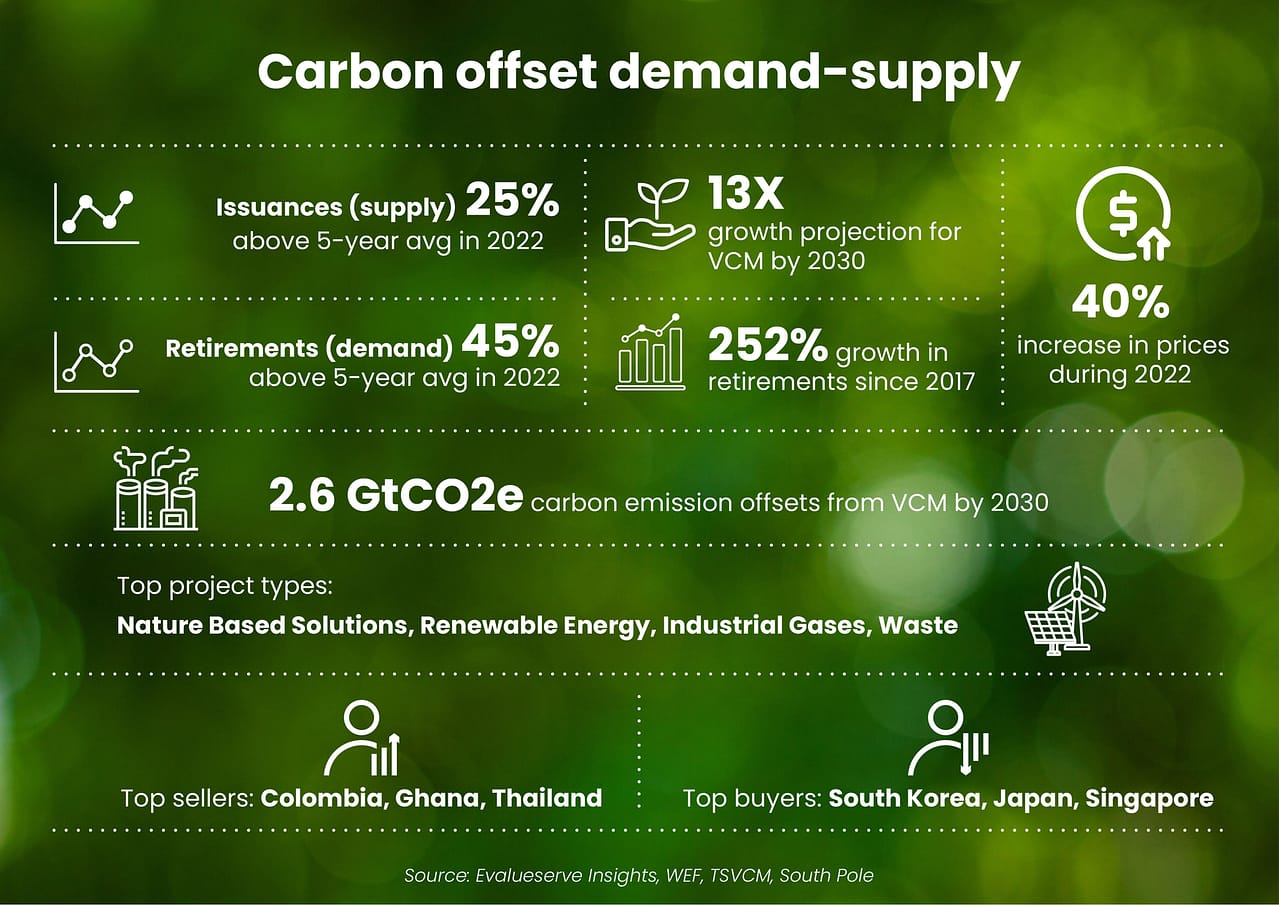

These projects offer carbon credits for industries and organisations seeking to offset their as-yet unavoidable carbon footprint. While there exists room for various participants and investors as well as project managers to fully understand the guidelines and standards governing the listing of credible and highest quality carbon offsets on platforms, their demand has been largely positive. We take a look at the factors driving and affecting demand-supply scenarios of this nascent decarbonisation solution, which has already sprouted a billion-dollar market, and is pegged to snowball into a sustainability giant offering a 'just transition'.

Demand and Supply

Challenges

As illustrated, the growth story of the VCM has only just begun, and high expectations are set for this decarbonisation solution over the coming decades. However, as with activity gathering momentum, there are some speedbumps including, in 2022 and early 2023, when the overall demand took a slight dip. But those may be considered time-bound corrections, as December 2022 also accounted for the highest single-month in carbon offset issuances. That said, the transparency of the VCM is one of its biggest draws, which simplifies identifying and resolving its challenges.

Standards: The standards governing the verification and ratings of various listed carbon offset categories and projects vary as per the individual policies of respective private registries. For, the VCM is not governed by international or national regulatory bodies, unlike the compliance carbon markets (CCMs) which function under the Nationally Determined Contributions (NDCs) from the Paris Agreement of the UNFCCC. This means no two VCM carbon credits in the world are created equal at the moment.

Quality: With varying standards, it can be a challenge to control the quality of offsets. This has been illustrated in the recent reporting of some Reducing Emissions from Deforestation and forest Degradation (REDD+) projects approved by a leading certifier not serving their claimed carbon abatement, community inclusion and development, or fulfilling the additionality criteria. This brings into question the integrity and efficacy of said projects, putting, among others, some top global companies which invested in those projects on the backfoot. REDD+ carbon offsets have multi-faceted co-benefits and have hence been among the top project types in demand terms on the VCM.

Policy: As stated, the VCM does not fall under a central governance body, which means that the credits generated from voluntary market projects, which are also listed on compliance markets could lead to being double-counted, leading to a dissonance in actual carbon emissions and offsets within a geography. While new provisions under Article 6 allow for greater international cooperation on emissions reductions and removals transactions between countries, an unequivocal precedent has yet to be set for overall accounting of credits and offsets.

Price: Pricing for carbon offsets faces volatility from a range of factors, including demand for specific project types, their quality, market sentiment, and others. To ensure a demand-supply loop, the requirements of investors will need to be closely matched with the categories of offsets being offered. For this, expert guidance, better knowledge, and assurances will be needed to remove the uncertainty over which projects to choose.

Way Forward

VCM will play a key role in neutralising the last mile of carbon emissions for which reduction or removal may be unavoidable from immediately available solutions. South Pole estimated that if 1,700 of the total carbon emitters just offset just 10% of their annual residual carbon emissions each year, 30 GtCO2e worth $1 trillion of carbon finance could be mobilised within the current decade.

In this endeavour, the support from industries in the form of strong demand signals will play a key role. This signalling will enhance the drive for a bigger supply of carbon credits to the market by indicating the existence of a scenario, wherein, credits generated from most high-rated climate action projects will get taken up. We are already witnessing this in the form of higher-than-average retirements against issuances. Enhanced supply will also further drive the scale of the market to a point of encouraging down-the-chain companies and newer investors to step in, as they will observe opportunities that match their requirements becoming available.

Stronger standards in the verification and ratings of listed projects will encourage existing participants to expand their stakes in the carbon markets. With evolving standards, it will also be important for investors to take a portfolio approach while financing the carbon market to ensure that there is a push for innovation while also minimising risk for the stakeholders. There is no silver bullet or "one climate solution to rule them all". So, a portfolio approach will encourage a balance between long-term costs and short-term objectives.

As much as participating in the VCM is about abating carbon emissions and meeting Net Zero milestones leading up to 2050, some large-scale investors are also entering the VCM out of pressure from rebelling board members and from the consumers at large so they can exude a stronger presence in the global move towards decarbonisation. There have been companies that were caught off-guard making claims due to insufficient knowledge of the extent of their participation and their actual carbon abatement. It is time to move away from using catch-all phrases such as "net neutrality" and "carbon neutral" and assess as well as acknowledge where in the process of decarbonisation each major carbon emitter really stands.

As solutions go, there will be a growing reliance on natural climate solutions or NBS as they offer the most co-benefits while also serving to recover and restore natural resources. We have previously highlighted some of the pertinent solution directions including Blue Carbon, and Carbon Capture. There are various other technologies and project types as well. You can also read our views on current and upcoming trends from the VCM to know more.

Carbon Offset Platform: To tackle these challenges and gain all the advantages of participation in voluntary carbon markets, our team of experts at Evalueserve has developed our very own Carbon Offset Platform. This platform comprises a global database of projects from across various carbon offset registries, which helps you in analysing the best-fit project in terms of abatement as well as economics. To know more about how our Carbon Offset Platform can empower your decarbonisation journey, please connect with our team of experts today.

Get decarbonization publications delivered to your inbox by filling out the form below.