The Challenge

It’s easy to get comfortable when things are going well, but finding ways to improve and expand can be challenging. Growth, whether measured by the acquisition of new clients or finding new sources of revenue, requires going to the next level by refining processes and approaches. Relying on old opportunity identification methods proved to be time-consuming and inefficient when it came to identifying growth areas. A global payments services provider leveraged our Insightsfirst platform to gain insight into opportunities.

By taking an integrated approach towards payments intelligence, the Insightsfirst platform solution allowed the client to identify and take timely action on relevant, recent, and valuable potential opportunities in the payments market.

Our Solution

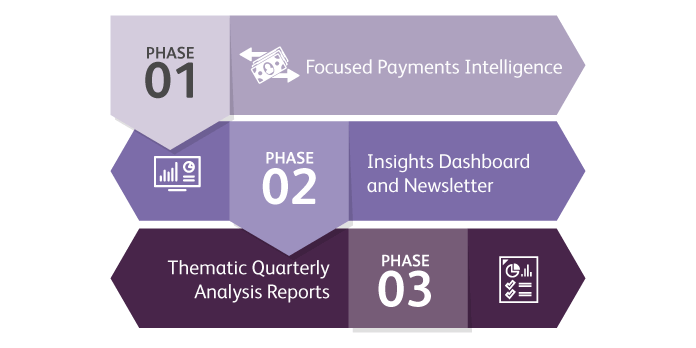

Our focus was on allowing the client to spot and evaluate emerging opportunities, in order to make well-informed strategic decisions. This is where the Insightsfirst platform enabled the client to pursue profitable opportunities and grow. There were three phases to the integration of the Insightsfirst platform, which were filtered and analyzed by domain experts, with each phase providing the best opportunities to the client.

Phase 1: Focused Payments Intelligence

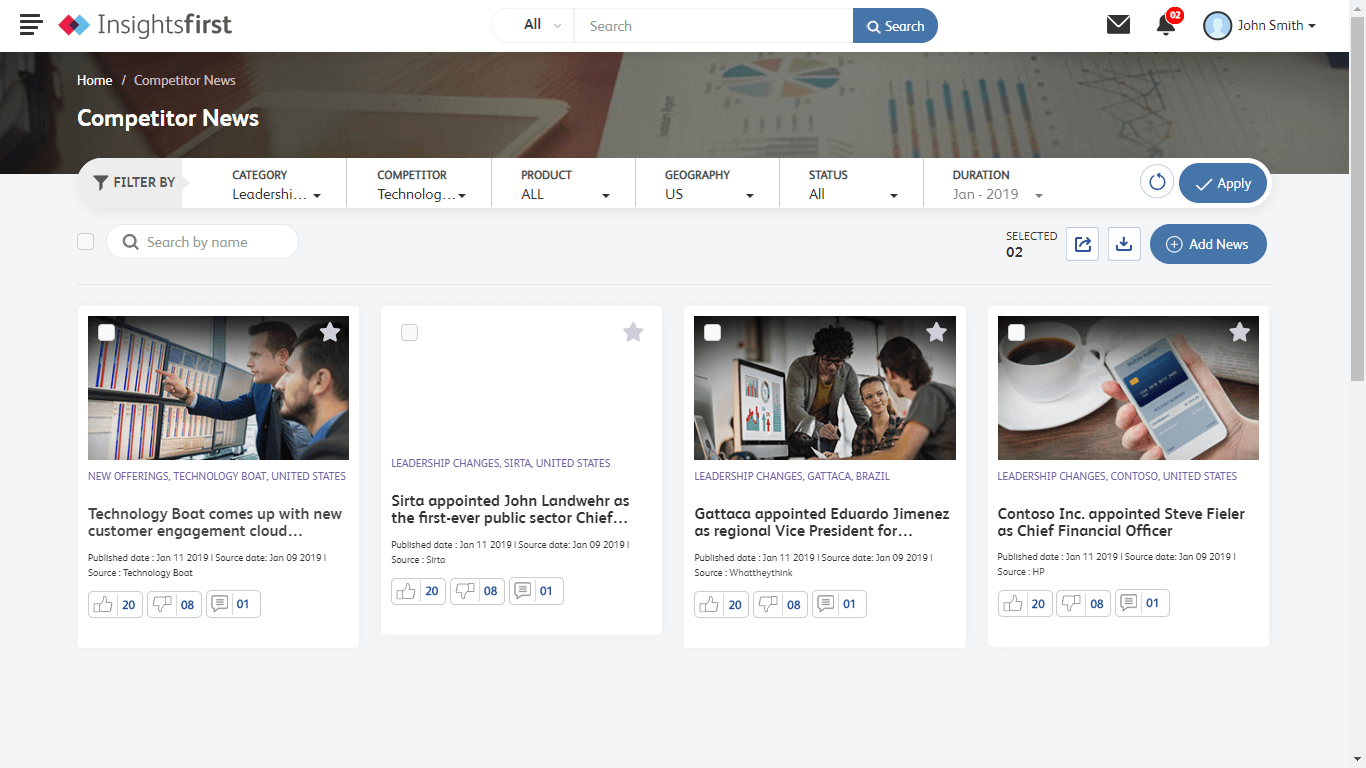

Emphasis was placed on identifying trends that were significant and impactful to the client. The Insightsfirst platform used smart filters based on Evalueserve industry mind maps to aggregate relevant information into separate categories. These results were then analyzed and filtered by domain experts in order to leverage output and measure relevance based on the client’s perspective.

Phase 2: Insights Dashboard and Newsletter

Focus was brought to integrating and compiling all sources onto the platform. These were then used to create an insights dashboard for updated daily newsletters delivered directly to the client’s team and stakeholders. The platform also featured multiple visualizations that provided the client with a snapshot of top trending themes or topics within the payments industry. Senior leadership could view these intuitive and highly visual dashboards, and therefore be equipped to pursue growth opportunities in the payments market.

Phase 3: Thematic Quarterly Analysis Reports

The final phase focused on developing insights from identified trends into detailed analytics reports that would be sent to the client’s key decision makers. Our domain experts broke down developments within the payments industry that included major payment trends, tips for proven business strategies, new resources and technologies highlights, and advice tailored to the client’s needs.

Business Impact

Key insights from the Insightsfirst platform helped increase the client’s direct revenue. In turn, this accelerated the global growth strategy of Big Banks by helping the client’s partner banks utilize this Insightsfirst platform to leverage their own strategy.

Increased direct revenue

The client leveraged the Insightsfirst platform to increase their direct revenue.

Won high-worth contracts

The client not only obtained information about new opportunities, but also recieved action items and insights that helped them win contracts.

Accelerated global growth strategy

Since the client was able to compare the potential of emerging payment markets to other global markets, they were able to make decisions faster.

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.