A top-five Canadian bank wanted to enhance their Credit Review process for Commercial lending in compliance with regulatory requirements

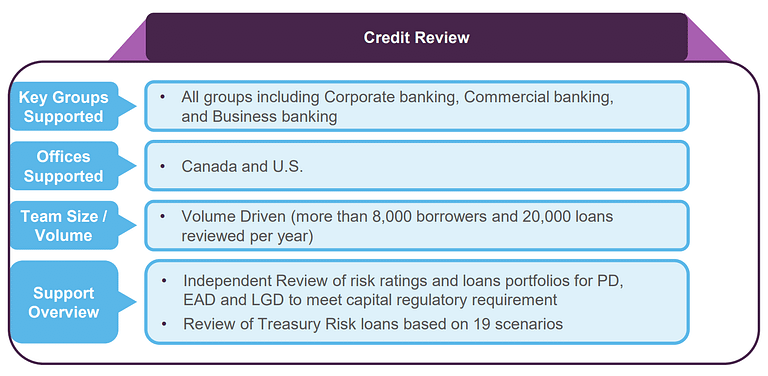

They wanted to partner to bring process excellence in their Credit Review function. A partner that could scale up staffing support on demand during surged period while maintaining the quality work was provided to client that helped with review of 8,000 borrowers and 20,000 loans per year.

The Goal

The Bank’s second line of defense function handled data quality checks for loans in all divisions including Corporate banking, Commercial banking, and Business banking as well. For this function, an independent review support was required to cover all credit review requests instead of a sample audit done by the Bank, thus providing a completely error free Credit applications and optimal usage of bank staff. This would also help in fulfilling the regulatory requirement of unbiased and timely review by third party.

Credit risk ratings are very critical in lending process therefore consistency in risk rating process and compliance against prescribed guidelines should be ensured. For this, comprehending capabilities for bank’s various Compliance guidelines and understanding of different Risk Rating Models is required. Further, this work needs to be handled by an experienced skillset provider who should be ready to provide extra review support during surged periods.

The Major Challenges

The bank had few core challenges and obstacles it sought to resolve, as presented hereunder:

- Inadequate coverage: The Bank relied upon verifying the loans on a sample basis as per regulatory requirements due to impractical and costly effects of examining all or 100% of a client’s records. However, there was always a possibility that the fields selected in a sample were not truly representative of the borrowers being tested, resulting to errors, hence not depicting a true picture of the credit review procedure.

- High turnaround time: In most of the cases, the average time taken for execution of a request was between two to three working days due to limited resources, which often led to delay in finalisation of the deals.

- Cyclicality issues: During surged periods mainly occurring at the end of the month or quarter, there always exists a high degree of risk of inadequate credit decisions due to the struggle to match resources with elevated volume of workflow.

Case Study – Providing Credit Approval Process Support for a Leading Canadian Bank

Team for Independent Credit Review

Why Evalueserve and How We Helped

- Evalueserve team drafted the detailed sessions to standardise the credit review process to eliminate redundancies and digitised the manual processes, resulting in improved time to market and reduced credit lifecycle.

- Evalueserve provided flexible staffing, quick turnaround, and uncompromised quality on urgent requirements. Evalueserve set up an offshore team within banks’ compliance and regulatory requirement, along with dedicated and specialised resources.

- Evalueserve created standardised credit review process template, based on different business models and also created database for archiving all the post and pre-Independent Credit Reviews, helping the Bank to understand the trends and errors while closing the deals.

- With our quick turnaround and uncompromised quality, the Bank has moved from its initial 5% credit review tasks to review of 100% deals. Furthermore, the Bank was able to focus more on the core processes resulting into improved efficiency and effectiveness of the Bank

Talk to One of Our Experts

Get in touch today to find out about how Evalueserve can help you improve your processes, making you better, faster and more efficient.