Europe’s Lost Green Hydrogen Momentum – An Opportunity for Global Suppliers

Discover the growth and challenges of Europe’s GH2 project pipeline. Learn about the potential impact on global hydrogen production.

Discover the growth and challenges of Europe’s GH2 project pipeline. Learn about the potential impact on global hydrogen production.

GH2 India 2024 will be the best opportunity in 2024 to engage directly with potential hydrogen

buyers, infrastructure, energy and tech companies designing the supply chain. It will bring

together key stakeholders and help fast track the growth in the hydrogen industry.

Explore the importance of clean aluminum production in reducing global emissions and its role in decarbonization technologies, along with potential approaches for a greener aluminum value chain.

Scope 3 emissions often constitute the bulk of a company’s carbon footprint. In this blog, we outline how companies can reduce their impact.

Discover the complexities of sustainable packaging materials and uncover the potential of Generative AI in achieving corporate sustainability goals.

Explore the synergy between Generative AI and Circular Economy, fostering sustainability, innovation, and responsible business practices for a prosperous future.

In this webinar, join decarbonization experts, Gauraveet Singh and Tarik Arora, as they share insights on emerging hotspots of activity, regional leaders and laggards, and all you need to know on new regulations for your sector.

Explore the potential of alternative raw materials (ARMs) in reducing CO2 emissions in the cement industry, as companies adopt low-carbon solutions and overcome challenges for a sustainable future.

Discover how Evalueserve’s macrotrends tracker and competitor intelligence monitor empowers energy industry players to navigate disruptions and seize opportunities in a dynamic market.

Explore the future of cleantech solutions driving the clean energy transition, empowering global industrialization, and supporting Net Zero 2050 goals.

How does upgrading the power grid affect transitioning to clean energy and meeting Net Zero 2050 goals without compromising energy security? What solutions can address this?

Explore the global shift towards renewables as clean energy investments surge, transforming the energy landscape and driving the emergence of new leaders in sustainable technologies.

Explore the factors driving the growth of solar PV technology and its role in the global energy transition. Learn about policy, efficiency, and supply chain challenges in achieving a sustainable future.

Explore top insights on the rapidly growing voluntary carbon market, its trillion-dollar potential, emerging trends, and how it supports global decarbonization efforts towards Net Zero 2050 goals.

Explore the growing voluntary carbon market and its potential for M&A activity, as companies seek to meet Net Zero 2050 goals and integrate carbon offsets into industry value chains for a sustainable future.

Explore how Evalueserve assists clients in navigating the growing voluntary carbon market, helping them stay updated on policies, investments, and long-term carbon offset projects.

Explore the growing demand for nature-based solutions and voluntary carbon markets, as industries aim to meet Net Zero 2050 goals and reduce greenhouse gas emissions.

Logistics companies are finding it challenging to accurately estimate their CO2 emissions as they strive to mitigate the impact of climate change. To achieve net-zero goals and comply with Scope 3 emission reporting requirements, companies must tackle data availability, accuracy, and transparency issues.

Evalueserve helped a waste-to-energy client identify their best-fit route to Voluntary Carbon Market participation. Our experts used our Carbon Offset Platform to guide them in maximizing the value of their carbon offset offerings. With VCMs gaining visibility, understanding how to generate carbon credits in this developing space is crucial.

Explore the transition to advanced E/E architecture in automotive industry: architecture types, challenges, and upcoming trends.

Discover how future mobility is transforming transportation systems with electric and autonomous vehicles and integrated transport solutions.

Voluntary carbon markets (VCMs) are crucial for achieving Net Zero carbon emission goals. With most credits generated from land-based projects, it’s time to explore the high-growth potential of Blue Carbon, which focuses on oceans and coastal wetlands.

Sustainability is the way of the future – that part is canon by now. So, what values can companies expect from the markets of this future? Well, the answer is right in front of us. The world is already witness to the emergence of a new type of market, where the highest valued ‘commodity’ is the decarbonization solution of paramount quality.

Voluntary carbon markets (VCMs) are a new-age solution that can not only help companies incentivize projects aimed towards climate change mitigation to meet Net Zero 2050 goals, but also help in the reduction and offsetting of greenhouse gases (GHG) and carbon dioxide (CO2) emissions for their investors and participants.

There is a global sprint towards reduction of carbon dioxide (CO2) emissions and greenhouse gases (GHG) across industries, in response to decarbonization needs outlined in the Net Zero 2050 goals as a part of the 2015 Paris Agreement.

The issues surrounding plastic waste and its mitigation require continuous focus in a global transition aiming for sustainability under the Net Zero 2050 goals. In recent times, we have noted this focus expanding.

Scope 3 emissions constitute the lion’s share of a business’s carbon footprint. Addressing Scope 3 emissions demonstrates a real commitment to the cause of environmental impact reduction. There are several approaches to Scope 3 emission reduction. Companies will usually need to focus on more than one strategy to ensure their attempts are effective.

Scope 3 is broadening the concept of environmental impact which includes all the activities a company’s business calls into being, throughout their supply and distribution chains (the “product lifecycle”).

Diversification is the name of the game once a business grows and takes on the moniker of an empire. And one major area of diversification, both from a growth and visibility standpoint going forward is sustainability.

Waste management becomes a critical factor impacting the achievement of circularity in any major value chain, based on the high volumes of consumption, even at the household level. Our team of experts took this criticality and turned it into a competitive advantage for our client with a focus on agility in the evolving market of waste management through this project.

At a time when various initiatives and long-term targets for achieving carbon emissions neutrality have been announced at the global, policy, as well as industry levels, respectively, we came across the opportunity to help shape the future of packaging in a high plastics consumption sector.

The global EV charging market is expected to reach USD 30.4 billion by 2023 and USD 35 billion by 2026. Extensive research in EV charging tech is vital for sustainable growth.

While the Indian EV market is growing at a brisk pace and so are plans and investments related to the development of charging infrastructure, the utilization rate of public charging stations in the country stands at a mere 7%…

A critical need of the hour towards the goal of sustainability, is better recycling, particularly in higher plastic consumption sectors, including consumer packaged goods (CPG). While a large quantum of post-consumer plastics ends up in landfills or leaking into the environment, the ones that do make it to waste collection and recovery facilities do not always end up recycled and reused.

Plastic has been an efficient material in the sales, transport protection, and modularity of consumer packaged goods (CPG). CPG companies are among the top plastic consumers and will hence be instrumental in reversing the material’s impact on the environment and, subsequently, the climate.

Hydrogen is a key contributor in moving towards a future powered by clean energy. We put together a round-up for you of our published content featuring this topic.

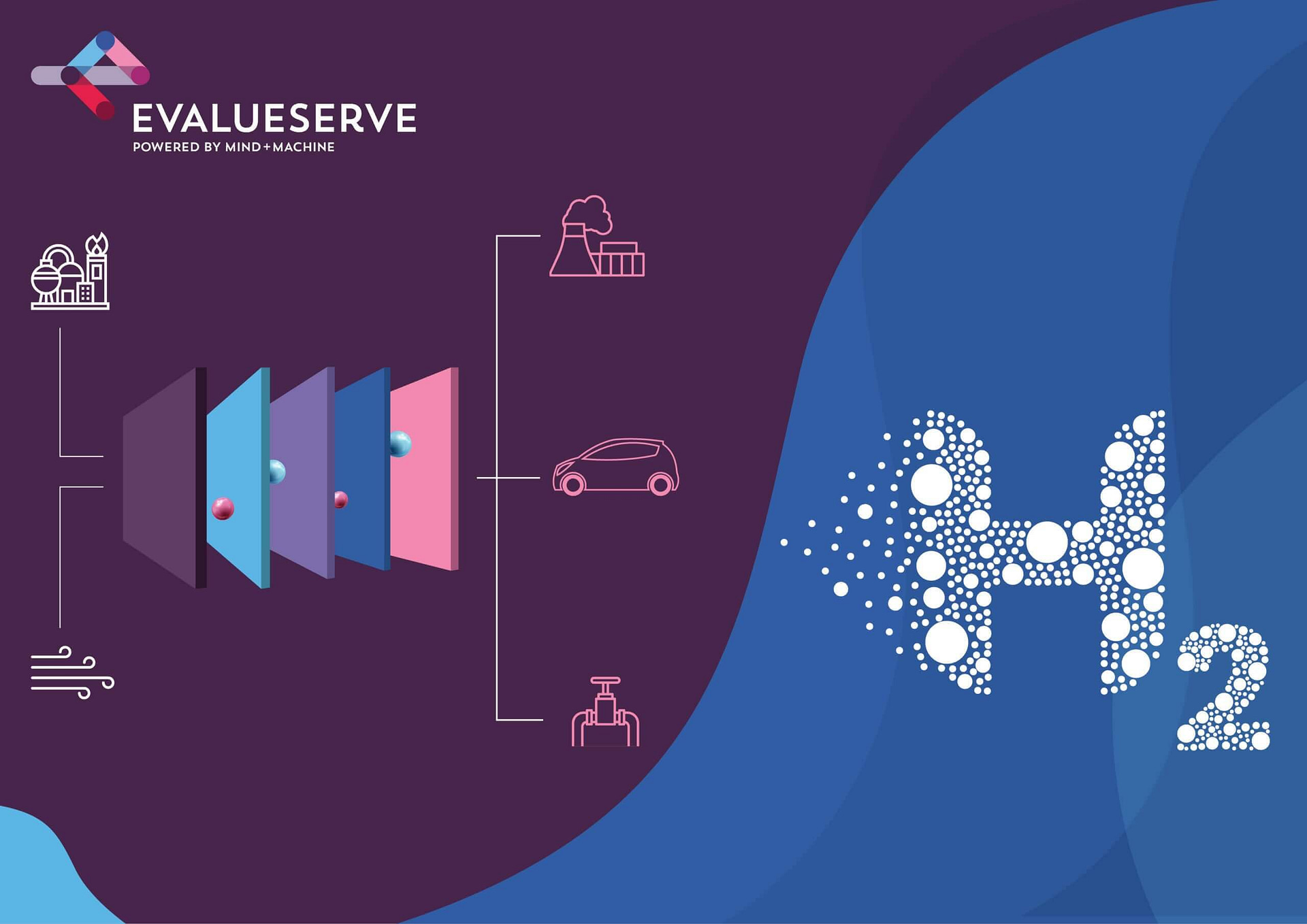

Our client, a leading global player in the cleantech solutions space, has an existing gas purification solution that could potentially expand into the hydrogen production process.

Hydrogen is seemingly everywhere when it comes to the future of green energy. Advancements in generating green hydrogen from efficient processes such as Alkaline, proton exchange membrane (PEM), and solid oxide electrolysis cell (SOEC) electrolysers are constantly pushing forward towards a competitive market.

Hydrogen is fast gaining ground as the fuel of the future, be it for power generation or powering the next generation of fuel cell electric vehicles (FCEVs). Hence, ways to generate, transport, and utilize it to fuel this energy transition are constantly being developed and optimized.

ESG efforts have seen three-fold increases over the last decade. With modern technology and the need for sustainable investments, companies and

Introduction As the 26th UN Climate Change Conference of the Parties (COP26) in Glasgow gets started, let’s take a close look

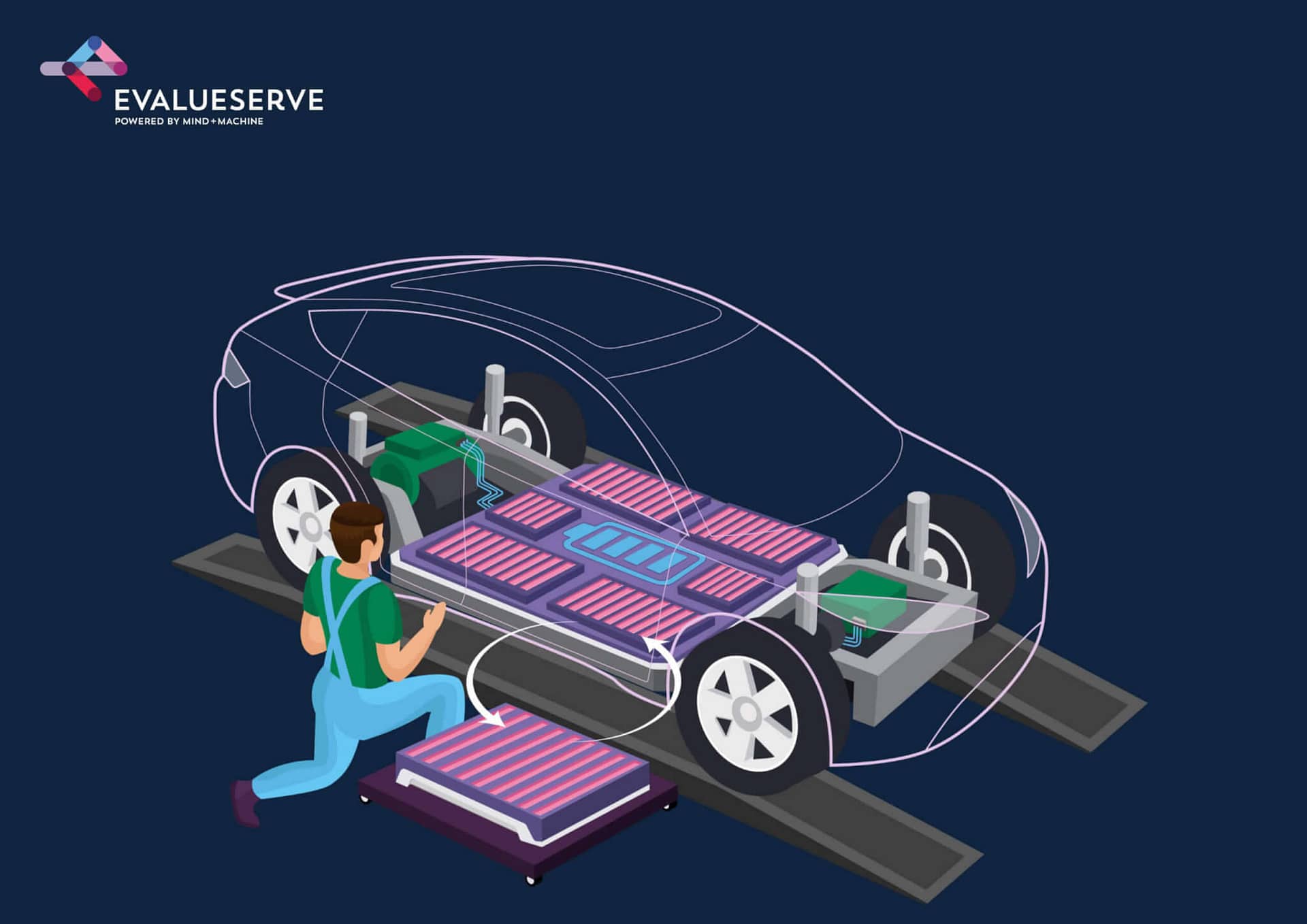

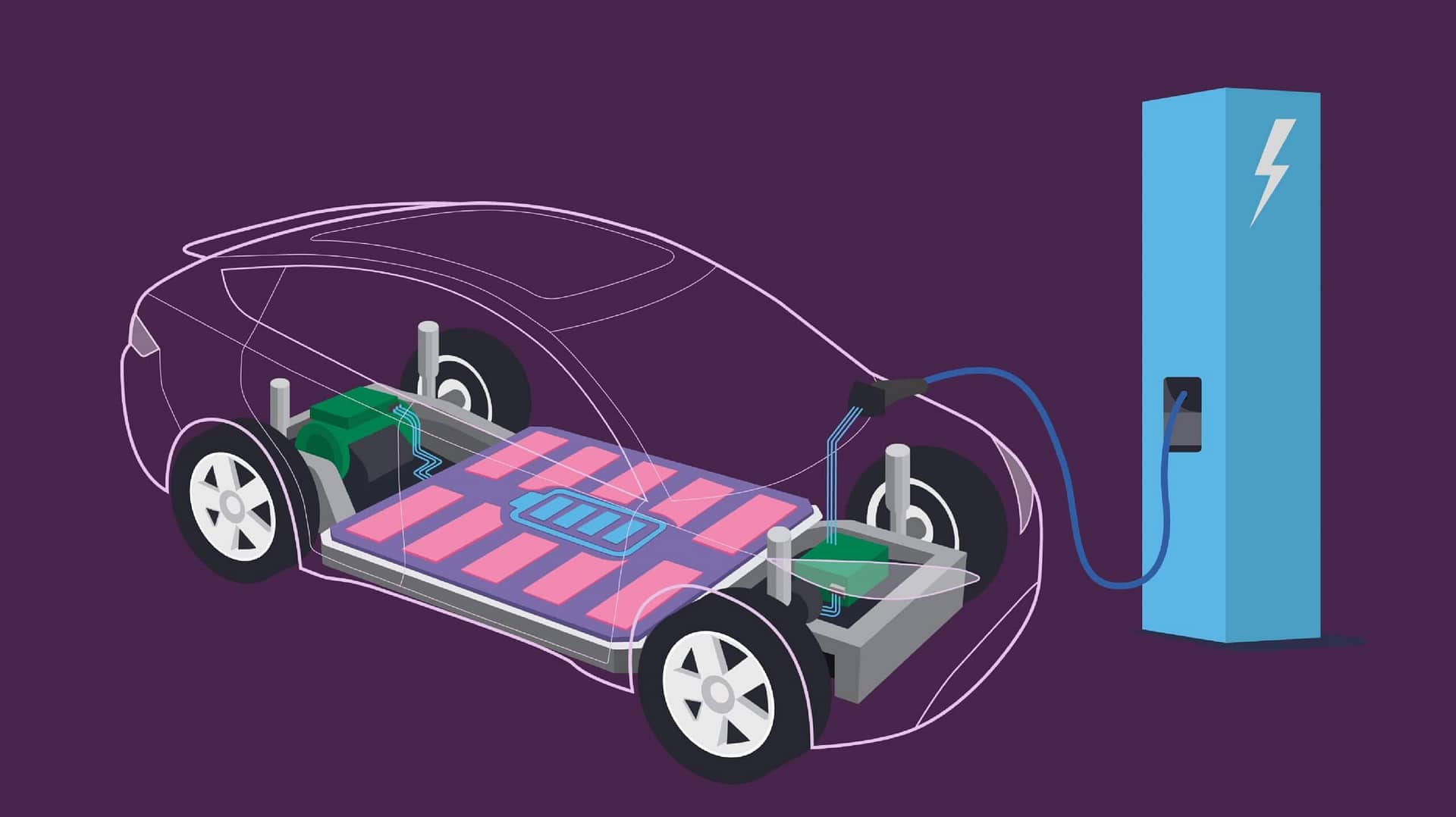

Introduction Battery as a Service (BaaS) is the latest in a series of buzzwords surrounding the hype of electric vehicles (EVs) and the future

Rising global temperatures and the need for ESG efforts has become important for every industry. What does that mean for businesses? Read the full industry insight here.

How soon can solar power become constant with the addition of energy storage, be cost-competitive with fossil fuels and how close is solar + storage to compete with conventional electricity sources like coal and gas?

Germany outlines roadmap for the use of power-to-liquid (PtL) fuels for its aviation industry.

The rise in steel prices over the last year has had significant effects on the solar power industry, let’s take a look at the impacts and the market.

A global conglomerate that designs, manufactures, and markets professional, industrial, and commercial products and services – wanted to understand where opportunities existed within the EV landscape.

One of the largest near-term opportunities for hydrogen is blending hydrogen gas into the existing natural gas network to cut down greenhouse gas (GHG) emissions. This insight discusses it’s potential and how.

Goals of carbon neutrality and decarbonization are paving the way for opportunities within optimization of present battery tech.

Electric vehicles (EVs) are the future of the automotive sector, and not a distant one. EVs, in their various forms, from plug-in hybrids (PHEVs) to battery electrics (BEVs) as well as the upcoming hydrogen fuel cell EVs (FCEVs), are racing towards ubiquity carried along by the fervor for the net-zero carbon emissions by 2050 mission.

Energy transition is the core component of the global target to achieve net-zero carbon emissions by 2050 across geographies and industries. Although, as we dive deeper into the scale and pace of the efforts needed to limit global temperatures from rising by 1.5 degrees C, the word “energy transition” loses some of its relevance.

The oil field services (OFS) business suffered a double whammy in 2020 – depleting oil prices as well as COVID-19 – both of which led to deep cuts in capital expenditure by their customers and a negative impact on their profit margins.

Decarbonization is no longer simply a buzzword. It is here and the voices echoing it will only multiply and get louder as the global economies inch towards 2050. By this year, most developed nations have pledged to become carbon emissions neutral economy wide.

On April 22, 2021, United States President Joe Biden made a remarkable, if ambitious, announcement. Contrary to the previous Trump administration’s climate change denial, Biden has said that the government will cut America’s greenhouse gas (GHG) emissions 50 to 52 percent from their 2005 levels within this decade.

To support lubricant makers expanding into the future mobility space, we are following the fundamentals of our GREEN Framework, designed to generate insights to support decarbonization initiatives from strategy formulation to market execution.

A leading provider of bio-fuels and sustainable aviation fuel is tackling two of the behemoths of un-sustainability – what to do with municipal solid waste and how to decarbonize the aviation industry.

The use of hydrogen in industrial applications such as oil refining and ammonia production is not new, but it is yet to be adopted at scale in other industries such as transport and power generation.

RPA For Risk Model Management

Market Intelligence

Financial Spreading

Competitive Intelligence

Sector & Account Intelligence

MICI For Asset & Wealth Management

CI for Management Consulting Firms

Knowledge Management

ESG Intelligence for Asset Managers

Fund Marketing & Digital Marketing

Intellectual Property Strategy

Intellectual Property Management

MICI for Real Estate

Sector & Account Intelligence

MICI for Asset & Wealth Management

CI for Management Consulting Firms

ESG Intelligence for Asset Managers Fund Marketing & Digital Marketing Intellectual Property Management MICI for Real Estate

ESG Controversy Monitoring for Asset Managers

Patent Analysis

RPA For Risk Model Management

© 2025 Evalueserve. All rights reserved.