Steel has been ubiquitous as one of the base materials for all major industrial developments over the past century. And its role extends into the next major industrial revolution too –the energy transformation fuelled by decarbonisation. This is all aimed towards achieving the global goals of net-zero carbon emissions by 2050. In the solar energy value chain, steel is used as a base for the mounting structures of solar panel modules as well as in tanks, pumps, and heat exchangers. Hence, volatility in the prices of this essential metal this year has led to challenges for manufacturers of the mounting structures, which have impacted global solar power project timelines. Let’s take a closer look:

Steel price trends

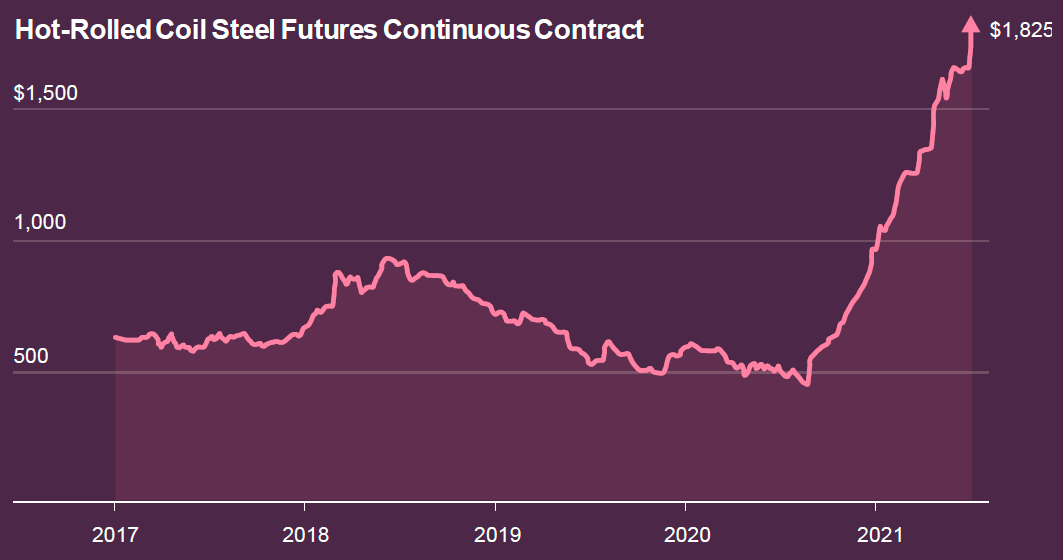

Steel prices had been soaring for the first four months of 2021, due to reduced supply. The reason was that various steel mills across geographies had shut off production in early 2020, anticipating the world economy was headed into a deep recession or even an economic depression. This decision came on the back of the Covid-19 lockdowns announced by various governments.

However, the demand for steel towards industrial use beat the steel mills’ anticipation and was even augmented by its demand for personal use during the past year. This rebound in steel demand caught the mills unawares, leading to lower supply and shortage in iron ore, the raw material which produces steel. Thus, when economies across the world started reopening after the lockdown, the demand had been rising, leading to steel prices hitting an all-time high in May 2021.

Steel prices continue to rise

- 1,878 million tonnes (mt) of crude steel was produced in 2020, marginally higher than the 1,874 mt produced in 2019.

- 10 times higher crude steel production than in 1950, when the number stood at 189 mt.

- 215% is the growth in steel prices since March 2020.

- $1,825 all-time high of hot-rolled coil steel future contract prices hit in 2021.

- $500-800 was the range in which steel traded prior to the pandemic.

- -14.4%finished demand had contracted in developed economies during 2019-20.

- 7.9% finished steel demand growth during 2020-21 across developed economies.

- 10.6% growth in steel demand during 2020-21 in emerging economies after a demand contradiction of -12.3% in 2019-20.

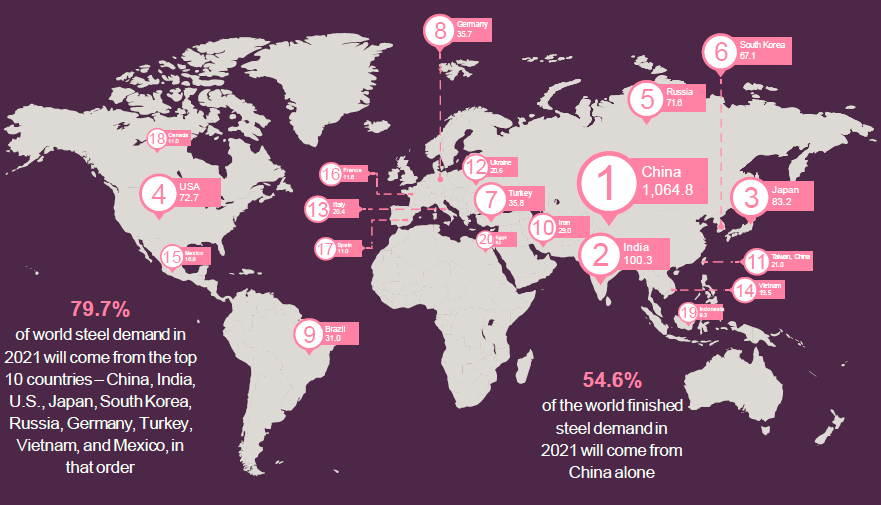

Top 20 steel-producing nations 2020 (mt)

Solar growth story

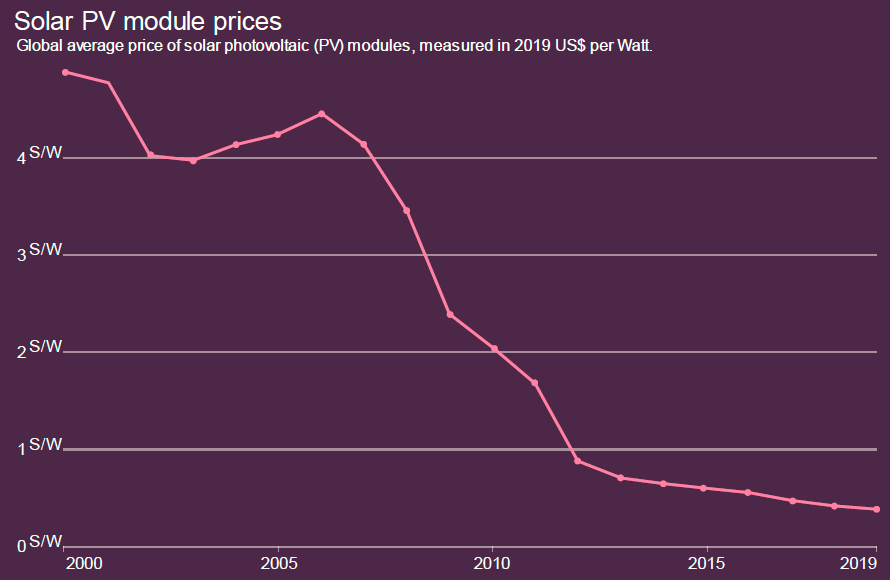

Solar power generation is quickly gaining popularity and can be seen as the most likely renewable source to replace the primary non-renewables as more players embrace decarbonisation. The growth potential and the fact that solar energy is the most abundantly available sustainable energy source is driving the rapid innovation development towards it. While solar power prices had been rising two decades ago, they had begun sliding down towards the middle of the previous decade, as economies of scale tipped in their favor.

- 127 GW of global solar power capacity was added in 2020

- 20.5% CAGR of solar power industry

- 10.3% rise in renewables installed capacity during 2020 over 2019

- ~50% higher solar capacity expansion in 2020 compared with 2019

- 92% drop in solar PV module prices from $4.88 per watt in 2000 to $0.38 per watt in 2019

- 48.85% of the total 260 GW of renewables capacity added in 2020 came from solar

- ~25% increase in solar PV module mounting structures during March-June 2021

Impact of steel prices on solar

While solar photovoltaic (PV) module prices had been on a downtrend over the last two decades, high commodity prices and shortage of metals including steel over the past year had pushed up the cost of manufacture for the mounting structures driving up overall solar PV module prices. Modules, especially in competitive emerging economies such as India and China, account for around 60% of the cost of a solar power project. This had led to many solar power projects temporarily slowing down and some being entirely put on hold through the early part of 2021.

How?

Manufacturers of mounting structures usually take around 2 months to fulfill orders. The price of the structures is decided by the solar project developers and structure manufacturers at the time of placing the order. However, steelmakers provide material prices to the structure makers on a weekly basis. This means that the structure makers had to buy steel at the volatile weekly price corrections after having already agreed to a competitive price with the solar project developers. This led to losses among the mounting structure manufacturers. Since there is no price validity backing from the steelmakers, mounting structure suppliers had to bear the brunt. With the fluctuation in steel supply, transport delays, iron ore shortage, the prices of mounting structures had gone up as much as 25% during March-June 2021. This led to the overall cost of solar projects rising in the range of 2% to 7%, leaving a dent in the margins of developers as well.

What next?

A large contributor in this supply ecosystem disruption has been dependence on China, which accounts for the majority of the solar PV components used in solar power projects across geographies. The price advantage which had helped Chinese suppliers remain extremely competitive also ensured that local solar panel building capacities in various nations remained impractical. However, when China faced industrial lockdown in the wake of the Covid-19 pandemic, the entire supply chain suffered.

While steel prices have come down from their all-time high witnessed earlier this year, prices will not relent quickly enough to bring everything back to pre-pandemic levels before 2022, or even 2023 by some estimates. To battle this, solar module makers in various parts of the world are pushing their respective governments to implement some incentives for local solar PV module production. Capping the reliance on import of base structures and other components can also help. While prices will go up in the near term even with these actions, it will help build local capacity and eventually reach the desired price parity while also stabilising supply.

Conclusion

The impact seen on solar power projects is a stark example of how reduced capacities or resource supply during crises can affect global efforts, in this case, those towards a clean energy future. Governments and industry will have to foresee and safeguard themselves against such challenges before they arise in the future, if we wish to see energy transformation and decarbonisation efforts proceed at the pace needed to mitigate climate change.

Download the full industry insight here

To discover how you can adapt for tomorrow, contact decarbonization@evalueserve.com .